Last Updated on May 24, 2018

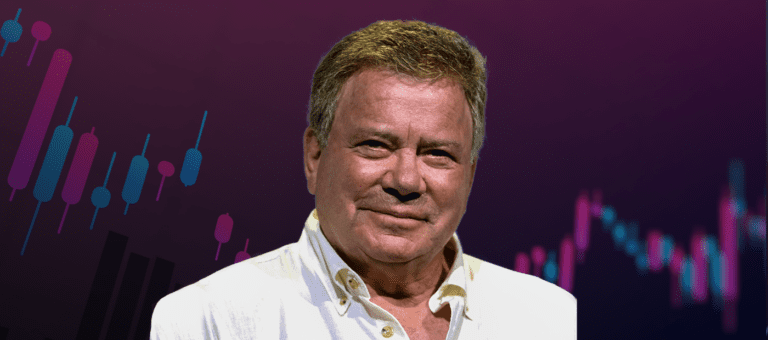

William Shatner was born in 1931 in Canada. His roots are in acting, gaining his fame for playing James T. Kirk in Star Trek. He has also worked as a producer, director, and musician and has written over 30 books. Today, we will look at a different side of his life: his endeavors in the market.

You might also enjoy:

First Contact with Investing

William Shatner covers his first run-in with trading in his autobiography, Up Till Now. This happened when he was a young actor in 1955. He had befriended Lorne Greene of Bonanza fame and discovered Lorne would trade daily. Lorne invited William to come to the stockbroker with him and another actor friend to see what trading was all about. He recounts that the brokerage and process of trading was the most amazing thing he had ever seen. Lorne’s ability to go in with some money each day and come out with profits was impressive to him.

Lorne was speculating in commodities. His consistent profits were tempting enough to make Shatner join in. Eventually, he did so, going to the broker’s again with Lorne. He recalls Lorne saying to him, “You’re going to make a lot of money, Bill.” William Shatner had saved $500 and wanted to use this money to fund a life of acting in New York City. He copied Lorne’s methods to give himself the chance to double his money. Shatner put the entire $500 into a long position on uranium, a hot commodity at the time. As we know, 100% is not a good fraction for anyone to risk.

Sadly for William, this did not go well. The next day, the prime minister of Canada gave a speech about how they would stop buying uranium for the foreseeable future, which made prices fall. This cost William his entire stake and postponed his dreams of living in NYC.

William Shatner’s Return to the Market

William Shatner did not get back into investing until well into his fame. His acting has led to many lucrative sponsorship deals over the years. These include ad campaigns for Wendy’s, Crest, Oldsmobile, and World of Warcraft, among many others.

One of his most memorable advertising jobs was as the Negotiator for Priceline, beginning in the late 1990s. This is the point where Shatner entered the markets again. Instead of getting paid as usual for this position, he arranged a deal for a piece of the company. It was not publicly disclosed, but estimates for his compensation are as high as 125,000 shares of Priceline. This was during a time of feverish speculation in tech and prices soaring to unstable levels.

William Shatner and Priceline

The Priceline deal has led to a lot of speculation about the company’s value. In May 2010, a story went through many news outlets about how the deal that William Shatner struck with Priceline was worth $600 million. This was at a time when the stock had reached nearly $300 per share, but even a high estimate of his shares does not justify a total of $600 million.

On top of that, Shatner held these shares during the dot com bubble bursting in the early 2000s. For the second time in his life, he made the wrong move. He sold his Priceline shares when they were worth a small fraction of their current value. In an interview with CNN, he put it this way:

So the stock went up. But we’re all tied down, locked in. And then the dot-com bubble burst, and we all still couldn’t get rid of our stock. And we went, boom. It was worth pennies. Everybody sold their stock.

He later goes on to jokingly say, “Six hundred dollars, I think, was what my stock was” and “You’ve got to buy my record, and a few books, and the DVD.”

Selling at the end of the bubble means the $600 million profit estimate would likely be over 100 times what he really received for his Priceline stock. Also, William Shatner seems to be exaggerating the damage because the New York Times stated in October 2000 that he sold 60,000 shares before the drop, which would have earned him around $6 million.

Aftermath

It is easy to say in hindsight, but he would have profited with more faith in the company. Around 48% of the dot com companies had survived through 2004. Priceline is counted among giants like eBay and Amazon, who not only survived but whose stocks actually surpassed their heights reached during the frenzy of the dot com bubble. The stock’s price today is $1,850 per share.