Last Updated on September 5, 2023

For years, the futures market has been dominated by investments in the leading indices. In the last decades, however, traders started focusing on commodities, and the grain market in particular, as a way to diversify their portfolios with a high-potential investment opportunity. One of the preferred commodity investments is corn. The reasons include low margin (which attracts speculators), high demand (for both human and livestock consumption), lower total dollar amount, price swings, and more. This article will cover everything about corn futures on the CBOT (ZC). From contract specifications to how to trade them and some helpful trading tips to make you a better trader.

Corn Futures Contract Specification

The schedule is set on the 3rd Fridays of March, June, September, and December. Here is an example of an RTY contract from the CME:

| Corn Futures Contract Specification | |

| Contract Ticker Symbol | RTY |

| TAS Symbol | ZCT |

| Contract Unit | 5,000 bushels |

| Price Quotation | $5.00 |

| Underlying Commodity | Corn |

| Minimum Price Fluctuation | 1/4 of one cent (0.0025) per bushel = $12.50 TAS: Zero or +/- 4 ticks in the minimum tick increment of the outright |

| Trading Months | 9 monthly contracts of Mar, May, Sep and 8 monthly contracts of Jul and Dec listed annually after the termination of trading in the December contract of the current year |

| Settlement Method | Deliverable |

| Termination of Trading | Trading can occur up to 9:30 a.m. Eastern Time (ET) on the 3rd Friday of the contract month |

| Trading Hours | From Sunday to Friday – 7:00 p.m. – 7:45 a.m. CT and from Monday to Friday – 8:30 a.m. – 1:20 p.m. CT TAS – from Sunday to Friday – 7:00 p.m. – 7:45 a.m. and from Monday to Friday – 8:30 a.m. – 1:15 p.m. CT |

| Last Delivery Date | The second business day following the last trading day of the delivery month |

| Grade and Quality | Through December 2018: #2 Yellow at contract Price, #1 Yellow at a 1.5 cent/bushel premium, #3 Yellow at a 1.5 cent/bushel discount. As of March 2019: #2 Yellow at contract Price, #1 Yellow at a 1.5 cent/bushel premium, #3 Yellow at a discount between 2 and 4 cents/bushel depending on broken corn and foreign material and damage grade factors |

The Asset on the CME

In the United States, corn futures are traded at the Chicago Board of Trade (CBOT). The symbol for corn is ZC, and one contract of corn is worth 5,000 bushels. The minimum tick size is 1/4 cent per bushel, which is worth $12.50/contract.

We already mentioned that corn futures are a preferred investment choice for speculators and active traders as they are prone to sudden and significant price swings. Now, let’s see how a trading position might reflect these price changes.

Corn Futures Contract Specs Calculation

Let’s assume that the front month corn contract is trading at $4.50/bushel and makes a five-cent move up. Based on this, the value of the price move in terms of a single standard corn futures contract is as follows:

- For a full-size corn futures contract (5,000 bushels) – a one-cent movement is equal to $50

- For a micro-size corn futures contract (1,000 bushels) – 20% of the full contract (or $10)

$0.05 x 5,000 bushels = $250 – As such, a five-cent move in corn would equate to a $250 move in terms of a single standard futures contract.

What about a $0.12 move in corn? Let’s see what that would look like:

$0.12 x 5,000 bushels = $600 – So a twelve-cent move in corn would equate to a $600 move in terms of a single standard futures contract.

If we break this calculation down further, we see that a one-cent move in corn is equivalent to $50. If you multiply $50 per contract by the price move in cents, you will know exactly how much the futures contract’s value has increased or decreased. Furthermore, you should now be able to identify the corresponding profit or loss of your position.

Mini Corn Contracts

There are also tradeable mini contracts for corn. A single mini corn contract represents 1,000 bushels, which is 20 % of the full contract value.

It stands to reason that the mini corn contract’s tick value would also be 1/5 of the value of the standardized contract. Specifically, a one-cent price move in the mini-corn contract would be equivalent to $10 in the standard one.

You might also enjoy:

Contract Values

Another thing just as important as the tick values is the actual contract value in your portfolio. Here is a quick way to figure that out with some simple calculations:

Let’s build upon the previous example, where corn is trading at $4.50/bushel, and see what the value of a standard futures contract would be in this case.

To calculate it, we should multiply per bushel the market price of corn by the number of bushels within the contract. At least in the cases when we have more than one contract.

As per our example, we would need to multiply $4.50 (price per bushel ) x 5,000 (bushels per contract) x 1 (number of contracts). The result is a contract value of $22 500. Essentially, a single standard corn futures contract trading at $4.50 is worth $22 500.

Mini Corn Futures

So, what about the value of a single mini corn futures contract? We know it is worth 20% of the value of the standard one, and considering it is trading at the same price of $4.50/bushel, the calculation uses the following formula:

Mini Corn Contract Value = Market Price per bushel x 1,000 x the number of contracts

And so, for $4.50, a single mini corn contract has a value of $4,500 by using the following inputs (4.50 x 1,000 x 1).

Benefits of Trading Corn Futures

Before we discuss our tips on trading corn futures, it’s important to understand some of the benefits that trading corn futures offer. Here are some of them:

Liquidity

The corn futures market is a very active one. They currently have an average daily volume of over 300,000 contracts. The average open interest on corn futures contracts is well over 1.5 million. This deep liquidity allows traders to enter and exit the market with ease and minimal slippage costs.

Safety

Corn futures are CFTC regulated and traded on the exchange with central clearing. As a result, the counterparty risk is minimal. This makes for a safe and secure trading marketplace.

Extended Trading

Since corn futures trade around the clock, traders can stay abreast of major developments throughout the day and overnight trading sessions.

Ability to Use Leverage

Leverage allows a trader to use a relatively small amount of capital and control a big position. The use of leverage can help enhance your potential profits.

ncreased Ethanol Demand

As biofuels demand increases, investors and traders can take advantage of positive future price trends that will likely arise in corn.

Suit Any Trading Style

The corn futures market can be an excellent place for applying a fundamental or technical approach. If you rely mainly on fundamentals, there are plenty of reports that you can base your trading decisions on. If you are a technical trader, you can rely on the price charts to do your analysis. Both trading styles work well in the corn market.

How Corn is Traded in the USA

With over 14 billion bushels of corn produced in the United States every year, the U.S. is the largest producer and exporter globally. The country produces three times more corn (over 330 tons) annually than China, the second country on the list of top producers. The US exports approximately 2 billion bushels annually or 20% of the world’s corn supply. It makes up over 40% of the world’s total corn production.

Aside from that, corn is the most-grown crop in the USA nowadays. According to the United States Department of Agriculture (USDA), corn is the most widely produced feed grain in the US, holding 95% of the market.

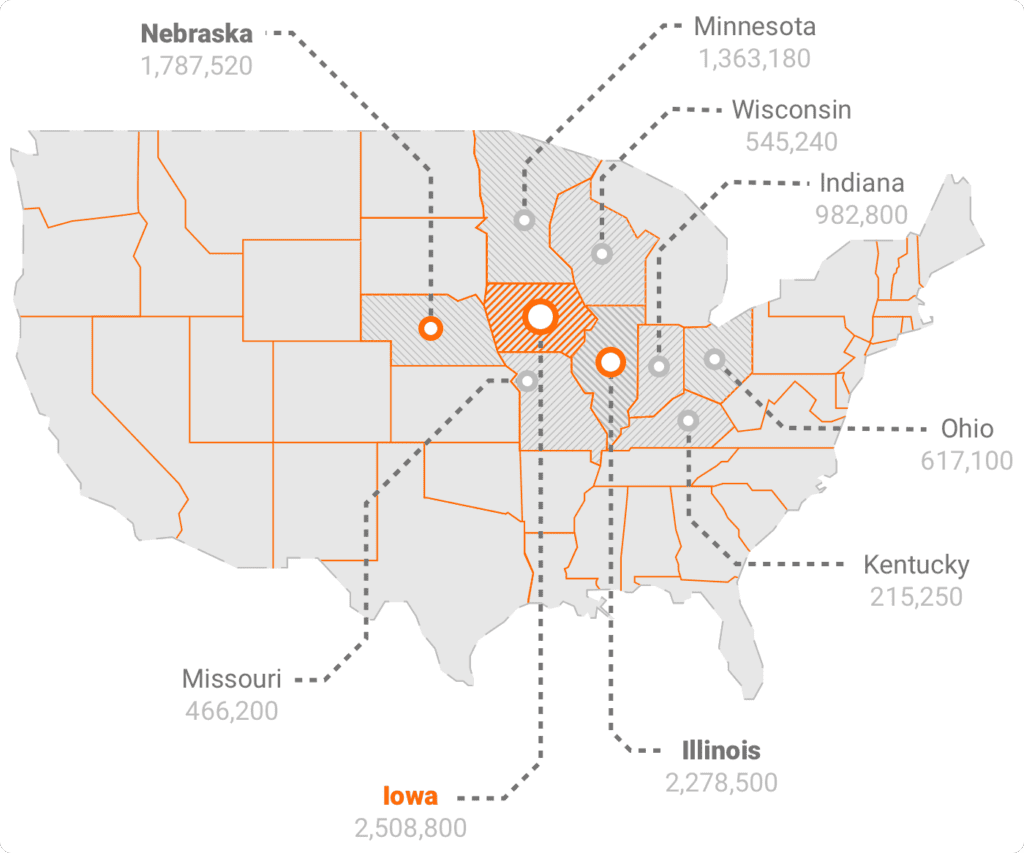

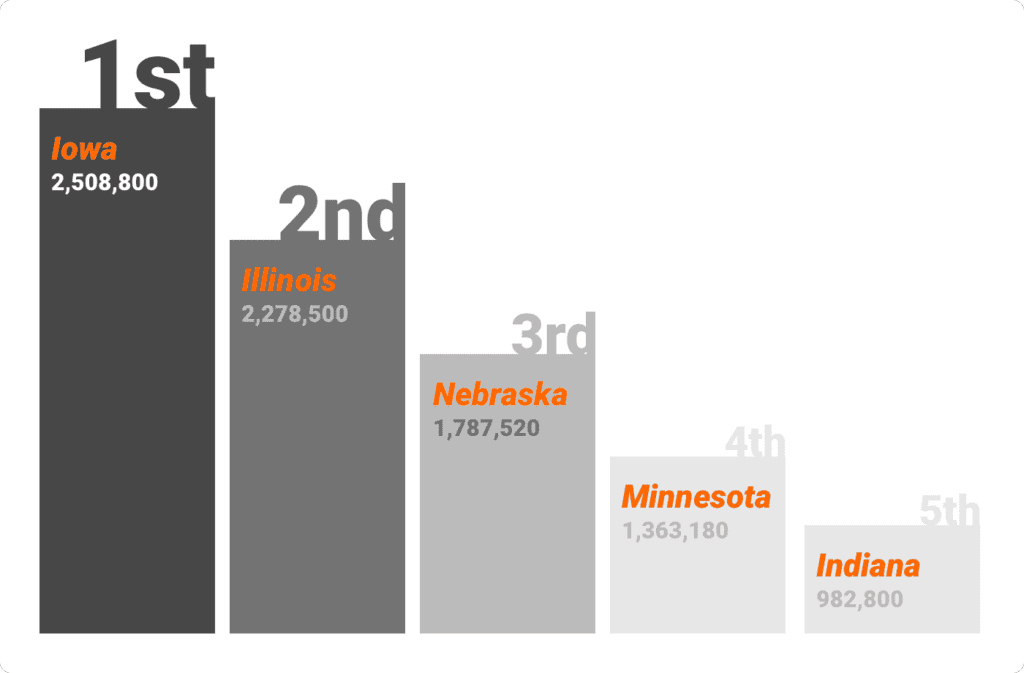

The primary geographic area within the United States for harvesting corn includes the Midwestern states with Illinois and Iowa, the two top producers. States like Nebraska, Ohio, Kentucky, and Missouri take up the remaining spots on the list of the biggest US corn producers. Statistics reveal that the USA has reserved approximately 91,000,000 acres (or 39m ha) of land for corn production.

Corn Producing States

To get a clearer understanding of the US’s corn production, let’s take a closer look at the numbers for the leading state. Iowa produces 2.7 billion corn bushels per year, or approximately 67.5m. This is more than South Africa, Indonesia, Canada, and India Put together. It’s even larger than the total production of the EU region.

The reason is rooted in the fact that corn production has been subsidized by the US Government since the 1930s when it became a leader in meeting post-war Europe’s demand. During the 1980s, the government increased corn production subsidies substantially. According to some estimates, for the twenty years from 1995 to 2014, the corn subsidies have averaged $4.7b per year.

Of the 14 billion approximate annual corn production in the US, 27% goes for Ethanol production, with another 10% dedicated to distillers’ dried grains with solubles. 33% of the corn goes to livestock feed.

How to Trade Corn Futures

The answer to this question is pretty obvious – just make an account with a broker, and you are good to go. However, in the next few paragraphs, we will focus more on the essentials that you should be aware of and provide some useful tips and tricks to help you understand in detail how to trade corn futures successfully. We will cover everything from the commodity’s specifics and factors influencing its price to technical topics like margin trading limits, leverage, and the best industry reports to keep an eye on.

Get Familiar With the Underlying Commodity

When trading indices, we usually research their components. It’s the same when trading corn futures. It is of essential importance for the trader to get to know the underlying commodity. That will allow them to be aware of all factors potentially affecting its price. These factors include the biggest producers, when it is planted and harvested, how its quality is measured, how it performed in the past, and how the corn futures market works.

Corn is famous for being one of the oldest and most important crops to people. It was first cultivated by the Aztecs and the Mayans, which created a path to its dominance in the Americas region. Today, it is the second most cultivated plant in our history, just behind wheat. Corn futures contracts had been trading since the mid-1880s.

Corn is a major source of food for both people and livestock. Other than as a source of food, corn is also used to produce ethanol, tires, whiskey, beer, paints, fodder, shampoo, toothpaste, pharmaceutical products (antibiotics and aspirin), and more. Due to its high viscosity, it is also used for adhesives and paper products.

The Importance of the Production Cycle

Before trading corn, it is also important to get familiar with its cycle of production. Corn is a warm-season plant that requires stable temperatures of at least 60°F, which usually arrive two-to-three weeks after the last frost in spring. Bear in mind that corn crops take anywhere from 60 to 100 days to reach harvest.

More often than not, it should be no surprise to hear the name Chicago Board of Trade mentioned when talking about corn trading. The reason is that the CBOT is the top corn futures trading destination worldwide. Aside from there, people also trade corn futures on the NYSE Euronext and the Tokyo Grain Exchange.

Quick Fact: In the trading world, corn has been called “the other yellow gold.”

Know Who You Are Up Against

This is important as trading is a world where market sentiments clash. To perform efficiently on the financial markets, you must know the rest of the participants and their behavior.

Corn futures are a preferred investment choice by consumers and producers in the first place. They buy and sell futures to lock in the price. Doing so guarantees purchases/sales with future delivery. Corn producers, for example, usually employ short hedges to lock their preferred selling price in advance. At the same time, the consumers rely on long hedges to strike the optimal purchase price for the real commodity’s future delivery.

What you need to know about these market participants is that they are reliable and usually come back each year/season. They have serious intentions as their production relies on corn delivery/sales. They typically trade in large quantities, which may positively affect the asset’s price. The behavior of corn producers and consumers is usually a great benchmark for the market’s health.

Corn futures are also enjoyed by speculators, whose primary goal is to benefit from the price movements and the market’s volatility. One of their characteristics is a more aggressive trading strategy. They typically buy and sell with no intention of possessing the asset.

Consider Indirect Factors

There are plenty of factors that determine the price of corn futures. While some are visible from the surface (weather conditions, supply and demand, and more), others remain in the shadows but can influence the price just as much.

Let’s take meat consumption, for example. The majority of the produced crop goes for livestock feed. According to statistics, the world’s meat consumption increased by 500% in the second half of the XX-th century. By 2050, some estimate it to grow by an additional 160%. This means the corn will grow in popularity; thus, its price will potentially follow if the demand isn’t met accordingly.

Macroeconomic Indicators

You should also take a look at the macroeconomic factors. We already said that the USA is the leading corn producer worldwide. This means the strength of the US dollar (or the economy) is detrimental to corn’s price. When the dollar appreciates, net exports go down as it becomes more expensive for foreign buyers to purchase it. This is also true vice-versa. That is why it is essential to keep an eye on the US economy as a potential trigger for changes in corn’s price. Also, make sure to keep an eye on the emerging markets’ economies, as well. If they slow down, their purchasing power will decrease, and the demand for exports will also drop.

However, the truth is that there is another way the US dollar can influence corn’s price. Consider a scenario where the FED keeps the interest rates low, which paves the way for speculation in various asset classes. The increased speculation may affect the corn market, and the prices could skyrocket. For example, if the dollar remains weak, this will create inflation, and corn’s price may rise.

What this comes to show us is that the asset class is pretty complex. To become a successful trader, you should be familiar with every detail regarding the factors that can influence the price of the commodity. Otherwise, you risk trading on wrong signals and suffer significant losses.

Keep an Eye On All Related Industries and Assets

Although most corn is consumed in the form of food, a significant part also goes to other industries as raw material.

Let’s take biofuel production, for example. Corn is used for producing environmentally-friendly biofuel that, in recent years, is enjoying increased interest. However, if competing sectors like solar energy, wind power, or hydroelectric technologies advance and prove to be a better and more affordable choice, the demand for corn as a raw material for biofuel production will drop immediately.

Make sure to keep an eye on the application of corn to produce all of its other applications and the respective trends in the particular industry. Let’s have a look at beer and whiskey production, for example. If the interest in corn-dominated alcoholic beverages in the US drops, it means the industry will have to rely on exports to maintain its strength. Or, consider pharmaceuticals: new and new antibiotics and drugs are produced each and every day. As the drug-manufacturing industry innovates, it may seek to transform its production by dropping some of the raw materials it uses, corn in particular.

Competing Assets

Also, don’t forget to track the price of assets that may indirectly impact the corn futures’ price—crude oil, for example. The commodity price is dictated by the demand for gasoline (geopolitical factors, supply and demand, and more). This, on the other hand, determines the demand for ethanol. As we mentioned already, corn is at the core of ethanol production. So, having high crude oil prices and low corn prices at the same time may drive the demand for ethanol higher. As a result, it would positively influence the price of corn.

The government is currently subsidizing corn farmers to increase the production of ethanol. Any major shifts in this policy would likely affect the price of corn. As such, traders need to be aware of the latest government policy surrounding it. Corn is becoming increasingly important for the production of ethanol.

As you might suspect, corn’s price is highly correlated to other grain products, including wheat, barley, and soybeans. Therefore supply and demand imbalances in these markets can often spill over to the corn market. You should keep an eye on these correlated markets for signs that could affect the corn market.

Strive to remain at the top of the recent developments in the relevant industries, as they may be detrimental to the short- and long-term price movements in the corn futures market.

Consider the Seasonality Factor

Part of being familiar with the underlying commodity has to do with understanding the seasonality of price patterns. During the late June to early July period, corn usually hits its peak price levels for the year. Mid-to-late July is when corn goes through its pollination phase, and moisture and temperature levels are critical.

When this particular period follows some sort of distress (a drought, some problem with production, etc.), the market tends to panic, which skyrockets the prices. When such a scenario occurs, the prices eventually start falling again naturally. Typically after traders realize that such extreme situations are generally rare and only last a short while.

On the other hand, corn prices hit their lows around the annual harvest period, which reaches its peak in November. The reason is that around that time, all farmers start selling their produce. This means the market faces a sudden boom in supply that exceeds the demand at that particular moment.

During the winter period, the price of corn usually stabilizes, and the volatility levels decrease. This is when you should shift your focus from domestic demand to exports, as they are a core factor for driving the price of corn around that time.

Be Aware of Corn Futures Margin Limits

By now, you should have a clear understanding of how to quickly and easily calculate the value of price moves and total contract amounts within the corn futures market. We can now move on to discussing the importance of staying aware of your margin limits.

The following explanation should help those that may not have a thorough understanding of margin trading within the futures market.

Margin is the bare minimum amount of your available funds that you will require to hold a leveraged futures position within your trading account. Each market has a different margin amount based on its volatility characteristics. It’s the exchanges that set these amounts.

Margin Types

You should be aware of two main types of margin, initial margin, and maintenance margin.

- Initial Margin – the minimum required capital to initiate a new position. It is the percentage of the purchase price of a security that you need to cover by cash or collateral when using a margin account.

- Maintenance Margin – The minimum required capital the trader will need to maintain an open position. If you fall below the maintenance margin requirements, your broker will either close your position or require you to post additional funds to cover the shortfall.

The minimum initial margin for a standard corn futures contract is $2,025. The minimum maintenance margin for a standard corn futures contract is $1,500. The exchange adjusts these margins up or down depending on market volatility.

Use Leverage Responsibly

Many traders confuse the concept of margin and leverage. Although they are closely related, they are not the same. After we covered the importance of staying within your margin requirements, let’s now dive into the idea of leverage and how to use leverage responsibly.

Simply put, leverage allows you to control a larger position in an asset using a smaller capital amount.

An Example of Using Leverage

Let’s say that you have $5,000 in your trading account, and you go long on a corn futures contract at $4.00. Let’s assume that the price of corn rises from $4.00 to $4.40 per bushel. So, the actual rise in the price of corn is 10%. This would be your percentage profit on a non-leveraged position. On a standard contract of corn that would equate to a profit of $2,000 ($0.40 x 5,000 bushels = $2,000).

But what does this mean for your $5,000-account from the leverage perspective? Well, with the $2,000 profit from this trade, you would now have $7,000 or a 40% rise in your trading account.

The Risks of Using Leverage

Keep in mind, however, that leverage is a double-edged sword. If the price was to drop from your $4.00 entry point by the same $0.40 to $3.60, then you would have realized a 40% loss.

As such, it’s essential to use leverage responsibly. But what is the ideal amount of leverage to use? Well, that is a personal choice based on your risk tolerance. As a general rule, you should try to maintain a leverage limit within 3:1 or 4:1. You can still make substantial gains in terms of percentage points by staying within these limits. By minimizing the amount of leverage used, you will also protect your trading capital against a major single trade catastrophe.

Monitor Weather Conditions

Weather conditions heavily impact the price of corn. That’s why supply and demand imbalances can shift quickly in this market. You must stay ahead of potential changes in weather in the largest corn-producing states. These include Illinois, Indiana, Iowa, Nebraska, and Ohio. Bear in mind that extreme heat and droughts in the Midwest are the biggest fear of farmers and corn futures traders. So, make sure to keep yourself informed.

Although the worst-case weather forecasts rarely pan out, there are periods where crop damage due to excessive drought results in massive price increases. Corn’s all-time-high was right after a period of drought in 2012, for example. That is why traders usually consider selling corn during the summer months.

Here are a few tips on how to navigate such scenarios:

- Try to stay out of the market when weather-related events can cause increased volatility and risk exposure.

- Be aware of seasonal tendencies in the corn market.

- Every November, the price of corn swings downwards. This corresponds to harvest time, the period when supply is usually at its highest.

Although we can never be sure about catastrophic events, it is always better to prepare for the worst. It makes sense to stay out of the market when weather-related events can cause increased volatility and risk exposure.

Key Reports for Corn Futures

Whether you consider yourself a technical or fundamental trader, there are three reports that you should keep a close eye on as they can have a significant impact on the corn futures market.

USDA Report

Every Thursday, the USDA releases a report on exports. The report contains a detailed analysis of the demand for corn exports. It should go without saying that a strong export outlook is often favorable for the corn market and corn futures price. Besides, it is also a good idea to compare US corn exports to other exporting countries. Doing so will allow you to gauge any major discrepancies that may exist.

Planting Intentions Report

The USDA produces and releases this report at the end of March. It details the amount of acreage that farmers allocate for the planting of various crop commodities. Using this report, you can forecast the total expected size of the crop production for the season.

Grain Stocks Report

The National Agricultural Statistics Services (NASS) issues this report every quarter. It offers a state-by-state update on the stockpiles of corn and other grains.

Corn Production – Curiosities and Interesting Facts

Although corn is the second most-produced grain worldwide, there are some interesting facts that most people don’t know.

- Corn is used to producing insulation, dry-cell batteries, linoleum, fireworks, theatrical makeup, metal plating, tires, and more.

- The outer part of the corn’s kernel is used for livestock feed.

- The kernel is made up of four components, including protein, fiber, starch, and oil. The way they are processed determines where they can be used.

- There are two types of corn, sweet and field. Only 1% of the US-planted corn is sweet.

- Sweet corn is what people eat (fresh, frozen, or in cans) as a vegetable. Field corn is harvested when the kernels are dry and fully mature and is primarily used for biofuel production and livestock feed.

- More than 97% of Iowa’s corn production takes place in family-owned farms.

- Iowa produces over 30% of America’s ethanol.

- Corn is present in over 4,000 grocery store items, including shampoo, beer, cereals, snack foods, meat products, and many more.

- Besides yellow, corn can be produced in various other colors: purple, red, green, white, blackish, and bluish-gray.

- Corn is grown on every continent aside from Antarctica.

- A single corn bushel is enough to sweeten over 400 cans of soda pop.

- Approximately 2.5 gallons of ethanol fuel can be produced from just a single bushel.

- “Corn Belt” is a term used to describe the US states with ideal growing corn production conditions.

- The world record for tallest corn stalk exceeds 33 feet. The average corn height is around 8 – 10 feet.

- To produce one pound of corn, a farmer uses over 91 gallons of water.

- One acre of corn is estimated to eliminate over 8 tons of CO2 from the air.

Summary

By now, you should be quite familiar with the benefits of trading corn in the futures market. You should also be able to take away some key insights and tips that you can use to get started.

It’s important to remember that you need to take the necessary time to learn as much as you can about a new market. Knowing and learning the basics is key to building a strong foundation. From that point forward, you can apply various technical or fundamental models and test your ideas.

With its high liquidity, strong trending characteristics, and seasonal tendencies, corn is a phenomenal product to trade. I would encourage you to use this reference guide as a starting point from which you can begin developing your own methods for trading corn futures. Once you develop your trading strategy and are comfortable with your practice level, take the next step and get funded with The Gauntlet Mini™ here.