Last Updated on April 22, 2020

$5,000,000,000,000 is the combined capital overseen by the new mega-broker consolidated from the merger of Charles Schwab and TD Ameritrade. Schwab manages $3.8 trillion while TD Ameritrade handles $1.3 trillion. The USA’s two largest retail brokers have joined together into a titan in an almost monopolistic situation. Their enormous wealth of financial assets opens up a new stage in capital accumulation. It’s definitely good news for both of their customer bases and could also put a stop to or at least compete with the low prices of online start-up brokerages.

You Might Also Like:

The key term here is synergy. Both parties agree that due to the larger size of the resulting new company, they would be able to re-negotiate all of their current partner contracts & agreements with more favorable terms. The merger itself wasn’t a surprise, since there were already countless rumors suggesting that it would happen. On the other hand what did catch people off guard, was that the stock prices of both companies rose sharply. Typically, investors tend to sell off any stocks they have of the company that got bought out, while buying the stocks of the company that bought it. In this case, however, it seems the market sentiment is that both companies will benefit from the arrangement.

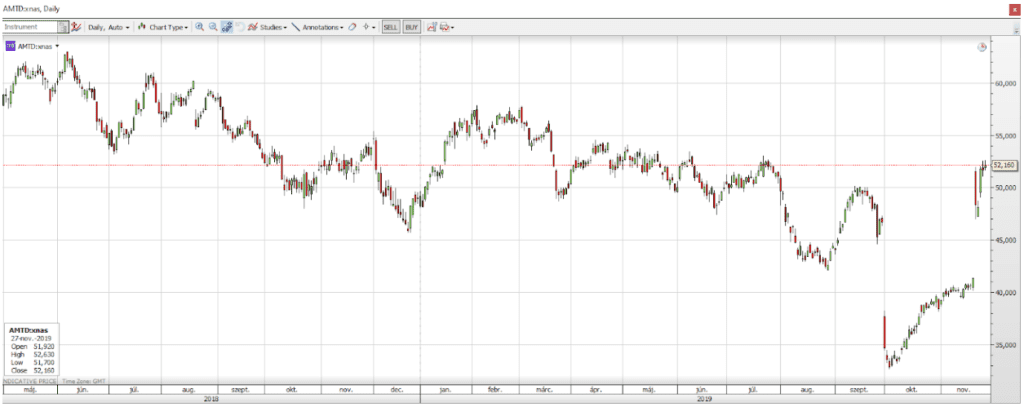

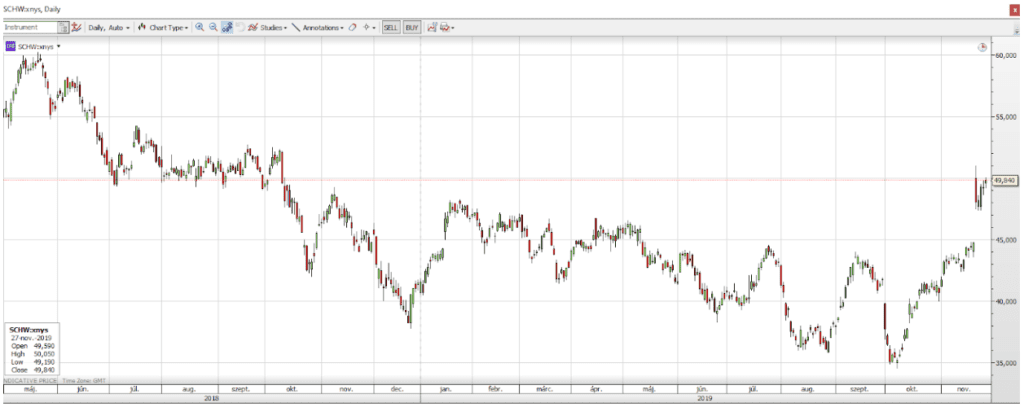

Charles Schwab and TD Ameritrade Share Comparison

TD Ameritrade rose to $52 per share, which is close to where its price was in August of 2019 and only $5 away from its yearly peak. The reason this is important is because back in October its price was still below $33 per share.

Charles Schwab’s shares also had a similar price pattern. What makes their case even more interesting is that their prices actually rose even higher than their 2019 peak.

These movements indicate that the market generally sees the merger as a positive for both companies. That said, the specifics of the deal also contribute this correlation in stock prices. According to their agreement, each share of TD Ameritrade is worth 1.0837 shares of Charles Schwab. Applying that multiplier to Charles Schwab’s current $49.85 share prices we get $54.02. This is what they themselves expect TD Ameritrade’s shares to be worth after the deal’s announcement. Although its actual prices are $2 below the expected value, that can easily be explained with investors simply preferring the buyer’s shares instead. Part of the arrangement is that Charles Schwab will absorb and incorporate TD Ameritrade’s shares into itself. That would make them a 69% majority. Meanwhile TD Ameritrade’s shareholders will own 31%. It’s also worth noting that their operating costs are likely to decrease, which is also great news for shareholders.

After the merger

The funds handled by the new company will be substantial enough to rival Vanguard’s $5.7 trillion and brings them a step closer to Fidelity’s $7.8 trillion. Some analysts suggest Charles Schwab’s main motivation was mainly the other company’s Registered Investment Adviser (RIA) network. Despite the difference in capital, TD Ameritrade is associates with over 7,000 RIAs. Compare that to Charles Schwab’s approximate 7,500. These advisers are the driving force of commission income due to trading on a daily basis. According to their plans these RIAs would use TD Ameritrade’s day-trading optimized platform for an expected $3.5-4 billion additional annual profit in the coming years after the merger.

Update

Although there have been some delays in the deal due to recent events, spokespeople for the two companies have confirmed that it’s still scheduled to go through. (Link.)