Last Updated on October 12, 2023

Today’s investing landscape has seen a variety of trading styles. Depending on the specific asset you’re trading, certain strategies may present more advantages over others. If you’ve been trading stocks for a while, you’ve likely heard of day trading and position trading. One involves trading securities within the same day. The other involves holding a position for an extended period of time. But what about a trading style that’s somewhere in between? In this article, we’ll discuss what is swing trading, compare swing trading vs day trading, examine the best swing trading indicators, and talk about the best strategies you can use.

Swing trading is one of the most popular trading techniques out there. Part of the reason is its moderate time frame and focus on taking advantage of routine price fluctuations.

What Is Swing Trading?

The simplest definition is that swing trading is a trading style that utilizes technical analysis in an attempt to capture gains in a traded security over a period of a few days to several weeks. The goal here is to identify an overall trend and ride it to capture larger gains than is normally attainable in an intraday trading time frame.

Swing traders look to profit from sudden price ‘swings. He or she holds the asset for a relatively short period (usually two days to a few weeks) in the hopes that a significant swing will occur. They then take positions based on the expected direction of the next price swing.

Understanding How Swing Trading Works

Financial markets tend to move in waves, which we call swings in the price of the traded asset. There’s no market today that will trend up or down without having some sort of price retracement. Therefore, the general idea behind a swing trade is to capitalize on these swings and capture small gains within a larger overall trend and cut losses quickly.

The gains may be small but, if you execute it properly and consistently over time, can easily compound into pretty great annual returns. For example, position or trend traders may wait six months to earn a 30% profit. Whereas swing traders may earn steady 5% gains every week and could eventually record more gains than the other traders in the long run.

There’s no fixed period of time for holding swing trading positions. It can vary from a few days to even a few months. Additionally, while some traders actively look for volatile markets that have lots of movement, others may prefer more steady markets. In any case, swing trading is about enduring as “little pain” as possible by quickly entering and exiting your trades before the opposing pressure comes into the market.

Swing Trading in Practice

Swing trading looks simple enough. Although, traders should keep in mind that because it involves following a larger price range and shift, there’s always the potential for high exposure to the downside risk of losses. These losses could be beyond one’s initial investment. Traders must often employ calculated position sizing in order to decrease their level of risk exposure.

Note also that commission costs tend to be different. They can sometimes be higher with swing trading compared to other traditional trading tactics. As such, swing traders must make sure to take this into consideration so it doesn’t eat too much into their potential profits.

Pros and Cons of Swing Trading

Like any investment strategy, swing trading comes with its fair share of advantages and drawbacks. These include:

Pros

- Swing trading doesn’t require you to spend hours in front of your monitor since you can hold your positions for days or even weeks.

- Investors with a full-time job can take advantage of swing trading since they can simply enter a position, set their stop loss, and go back to focusing on their jobs.

- Swing trading essentially presents less stress compared to many other trading styles, like day trading.

- Swing traders mostly need only to rely on technical analysis to enter or exit the market, simplifying their trading process.

Cons

- Traders won’t always be able to ride trends since they’re not monitoring the charts 24/7.

- Traders must often deal with overnight and weekend market risk.

- There’s always the risk that sudden market reversals can wipe out all the short-term gains.

Swing Trading vs Day Trading

The two share certain similarities, but one key difference between them is the holding position time. Swing traders typically hold their positions overnight up to several weeks, whereas day traders must close their positions before the close of the market for that day. In day trading, the buying and selling of securities may last a few seconds or stretch over several hours — but it cannot go past that trading day. That’s not the only difference, though. Here’s a brief breakdown to give you a better understanding of how these popular trading styles differ:

The Main Differences

- Capital Requirements – There will be variations in capital requirements depending on the type of market being traded. A day trader holding futures contracts will have a different capital requirement from a swing trader trading in traditional stocks. For example, day trading stocks in the U.S. typically requires upwards of $20,000. On the other hand, there is no set legal minimum limit for swing trading stocks. Still, swing traders must make sure their trading accounts are sufficiently funded if they actually want to see profits.

- Potential Returns – Day trading usually revolves around wanting to make a quick buck through compounding returns at each session. However, it’s never that easy, because it means they have to make twice as much as they lose while also winning at least 50% of their trades. For inexperienced traders, this may result in faster losses than faster gains. Meanwhile, swing traders tend to accumulate gains slower, while looking to cut losses quickly. But even though their potential returns are slower to accumulate, they still have the chance to make huge gains.

- Position Size – Because day traders must close their positions before the market closes for the day, they tend to take larger position sizes. Especially since they’re constantly monitoring the charts for any sudden price changes. They also often trade with leverage in order to maximize their profits given that their more frequent trading can lead to higher transaction costs, which can considerably eat into their profits. Swing traders, on the other hand, have to deal with the risks associated with holding their positions overnight and therefore tend to take smaller position sizes.

Swing Trading Strategies

Curious about the specific strategies used by swing traders? Here’s an overview of some common ones:

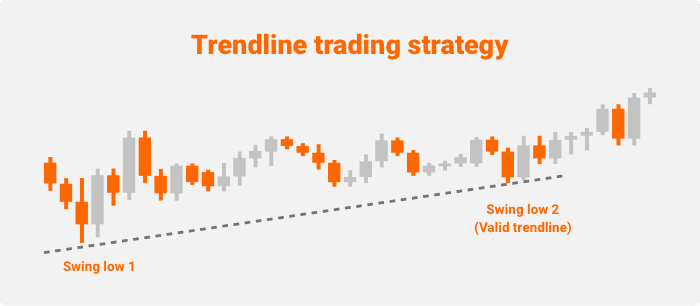

Trendline Trading Strategy

This is one of the most popular swing trading strategies out there. After all, buying at the bottom and selling at the top means you must fully understand trendlines. This strategy relies on the use of technical indicators to identify and confirm market direction and momentum. Take a long position if the trend is going to reach higher highs and there are no bearish reversal signals. Take a short position if the market trend is expected to go lower with no short-term bullish reversals. A similar approach to this strategy is to draw trendlines on the chart and simply wait for the price to touch them. When this happens, do an analysis for bullish or bearish reversal candlesticks, then buy or sell accordingly.

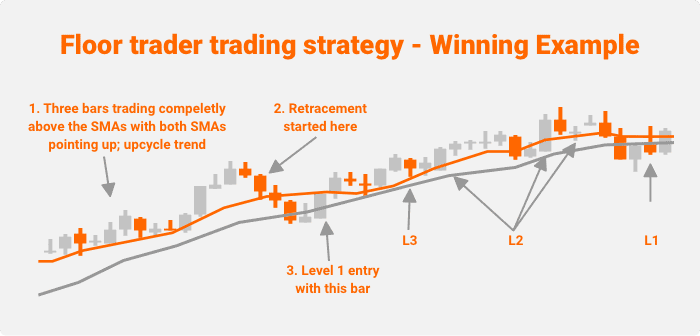

Floor Trader Strategy

This simple, yet powerful retracement strategy, involves using the Moving Average (MA) lines to identify stable trends. Then using a pullback formation to determine when to enter the market. On the chart, plot the 9-day exponential moving average (EMA) and 18-day EMA lines and wait for them to cross. Next, watch for a price breakaway after the moving average (MA) cross and a following pullback (the price comes back to touch either of the two EMA lines). Once you identify a bullish or bearish reversal candlestick, place your buy or sell position accordingly. The Floor Trader strategy is quite popular thanks to its ability to let you know when there is a stable trend, thereby determining the ideal time to enter the market.

Range Trading Strategy

This is a popular swing trading strategy that involves the trader utilizing indicators to identify support and resistance areas (or overbought and oversold areas) on the chart. Range trading works well in markets that are zigzagging with no apparent long-term trend. Essentially, you’re looking for the price of the asset to stick within a specified trading range between a stable support and resistance level. This means first identifying the market range or channel on the chart and then waiting for the price to break above the resistance line or below the support line. If the price does break through the resistance, watch for a strong price rejection (a close below resistance or above support). Once you see such a strong rejection, take a short position on the next candle. The reverse is also true when the price breaks below the support. If there’s a strong rejection once the price falls slightly below the support, take a long position on the next candle.

Fading Trading Strategy

This strategy involves trading against the trend, hence traders also call it countertrend trading. It is where a trader takes an opposite position following a market movement with strong momentum. Fading is based on the idea that the market will slightly return to its recent average price after a strong movement. Hence, traders look to enter the market as soon as the price swings lower and quickly exit before the end of the countertrend and the market goes back to its main trend again. It starts with identifying a strong trend that sets a new high past the resistance line. Wait for a strong price rejection then go short on the next candle and profit from the next swing low.

Top 3 Best Indicators For Swing Trading

As you can see from the above, most if not all, swing trading strategies require you to be knowledgeable in technical indicators to identify profitable entry and exit points. Here are some of them:

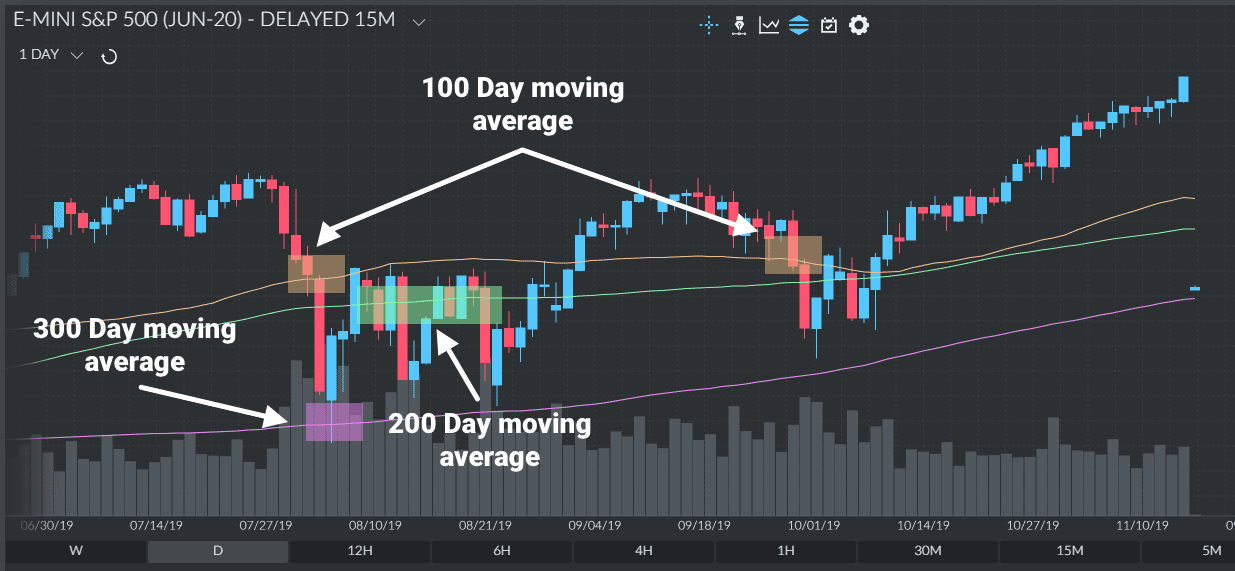

1.) Moving Averages (MA)

The moving average (MA) can be used as a swing trading indicator. It looks at the closing price data over a period of time to identify and confirm a trend. It is plotted based on the number of days being measured. For instance, using a 100-day MA means adding the closing price of the asset for each of the last one hundred days and dividing them by 100 to get the average price. The points are then plotted in a single line to smooth out market movements and provide the trader with a better overview of the overall trend over that time period.

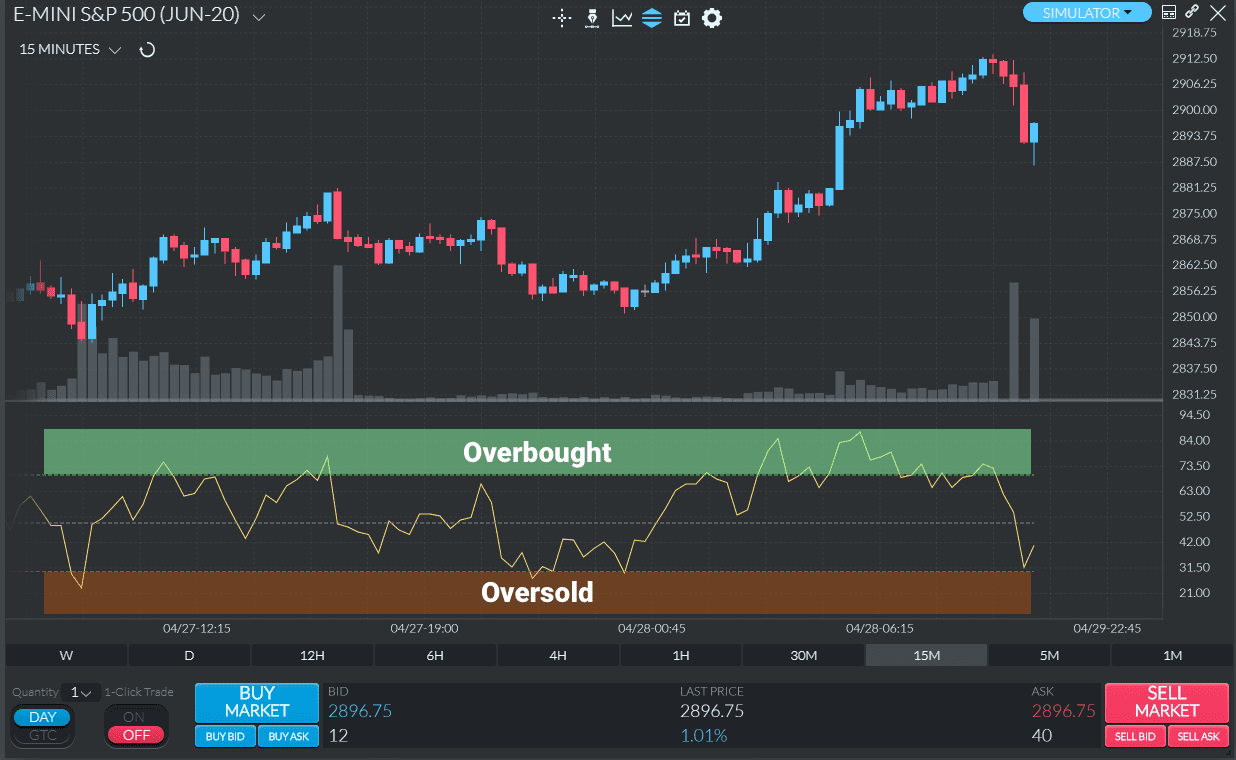

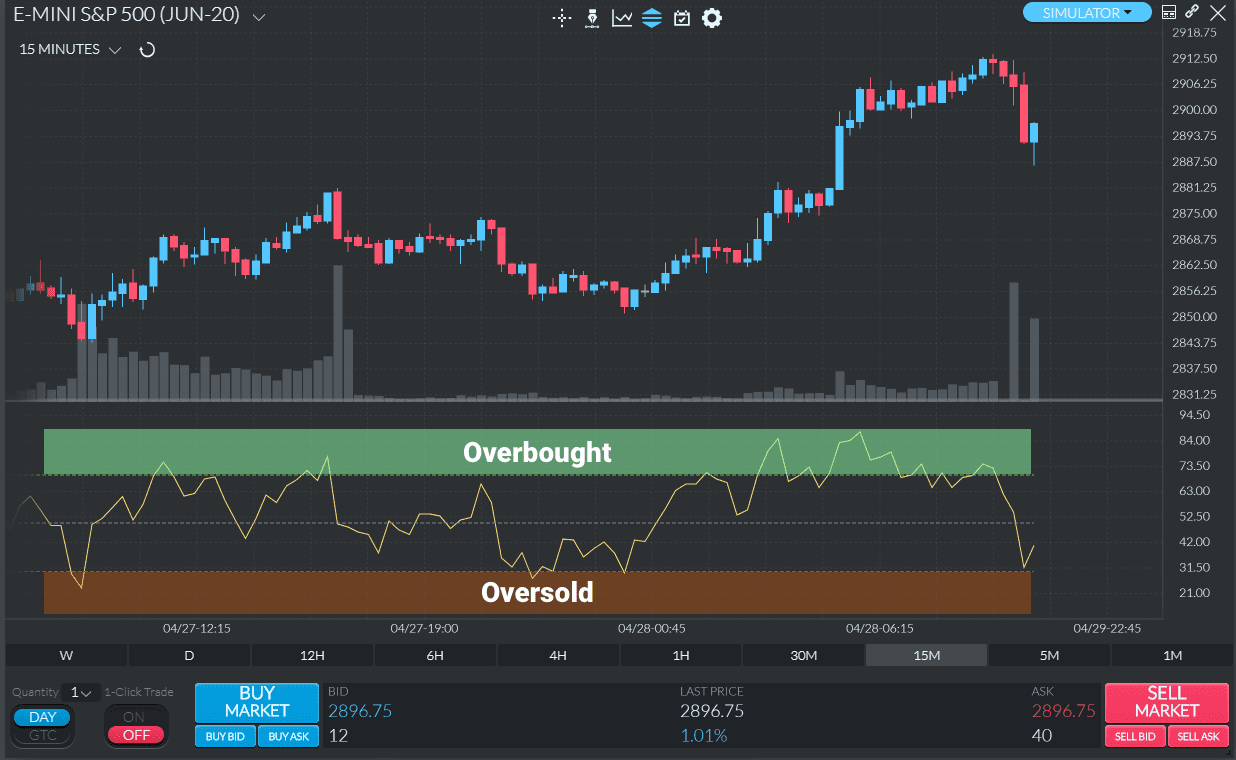

2.) Relative Strength Index (RSI)

Swing traders use the Relative Strength Index (RSI) indicator to capture swings in the overall trend by determining whether a particular market is deemed oversold or overbought and therefore getting ready for a ‘swing.’ The RSI is represented on a chart from 0 to 100 with key points set at 70 and 30. The market is considered overbought if it is trading above 70 and is usually a signal to exit the position. On the other hand, a market is considered oversold if it’s trading below 30. That’s usually considered a signal to enter the market to profit from the expected price rise.

3.) Bollinger Bands

Bollinger Bands are a trio of lines comprising an upper band, a lower band, and the simple moving average (SMA) line of the asset price. The upper and lower bands represent the positive and negative standard deviations of the SMA and are a great way to measure market volatility. The bands expand farther away from the SMA when there is high volatility and contract closer to the SMA when volatility is low. When the price touches the lower band, the market is undervalued. That’s a good time to buy. When the price touches the upper band, the market is overvalued and it’s time to sell.

Popular Stocks For Swing Trading

Picking the right stocks to swing trade is one of the most important things to master before proceeding with live trading. After all, what’s the point of learning about a new trading style if you’re going to end up trading the wrong assets? In any case, the best stocks for swing trading are those with the following features:

- Large market capitalization – this makes the stocks much easier to buy or sell quickly with more liquidity.

- Relatively calm – You’ll be holding your position for a few days or weeks so the asset you’re trading shouldn’t be experiencing extreme volatility.

- Catalyst – Securities that have a catalyst to trigger a powerful move in its market value are ideal for swing trading.

Based on these qualities, here’s some top stock picks to consider for swing trading:

- Facebook (FB)

- Microsoft Corp. (MSFT)

- Apple Inc. (AAPL)

- Zoom Video Technologies (ZM)

- Snap, Inc. (SNAP)

- Carnival Corporation (CCL)

- Mastercard, Inc. (MA)

- MKS Instruments (MKSI)

Conclusion

Hopefully there is enough information here to get you started on becoming a competent swing trader. We’ve covered various aspects of the topic from ‘what is swing trading’ to some of the common swing trading strategies, to even some of the best stocks for swing trading. Remember to keep practising with a virtual account until you are confident enough to go live.