Last Updated on June 8, 2021

The term bubble has become widely used, even outside its stock market origins. It refers to assets whose price is inflated by traders and investors far above their actual value. Once investors realize that the asset won’t return the profits they hoped for, the stock market bubble bursts. At that point, the stock’s price tends to decrease drastically due to everyone rushing to sell off whatever shares they have. Ardent short sellers are always on the lookout for the latest bubble they can trade short. Stock prices aren’t famous for being quick to rise, but when they crash, they plummet. These sudden descents are incredible profit opportunities, but they also have their fair share of risk to match.

You might also enjoy:

The Development Of A Stock Market Bubble

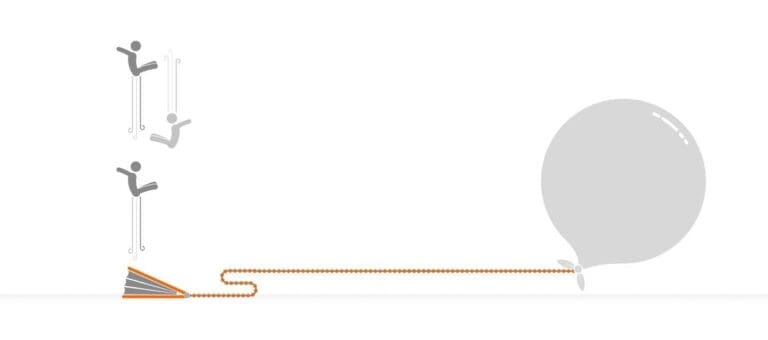

Stock market bubbles develop in several distinct phases. There are several ways to categorize them, but for our purposes, we’ll use three. Many traders have lost money due to failing to distinguish between these phases and entering their trade at the wrong time. One of the dangers to look out for is getting in too early. The initial stage of its development is often accompanied by expeditious growth. If you’re too quick to place the order, you may end up holding the asset for a painfully long time before the best opportunity to sell comes along. Maintaining these positions or simply being unable to use that capital for anything else is often a loss in itself.

First Stage Of Development

The first phase is the initial build-up, where institutions and big investors have the center stage; market actors who are more informed than the general public start opening positions on a promising stock. The number of positions in the stock is slowly pushing prices upwards. However, the lack of media attention means the growth still isn’t radical. This phase involves banks and other financial institutions swapping tips or keeping an eye on each other’s trades.

One of the ways to recognize this phase in the case of stocks is the increased number of management transactions. Board members of financial and investment institutions start issuing buy orders. Some hedge funds may begin to exceed the ownership limit when they have to start reporting their activity to the SEC. In the case of so-called small-cap and mid-cap companies, this can be as little as 10 million dollars. It’s a period of quiet, steady expansion.

Second Stage Of Development

The second stage is when it truly becomes a stock market bubble. Once positive flash reports and other good news start reaching the press, the number of buy orders on the stock begins to pick up as well. While it’s still not a bubble at this point, the notable improvement in the asset’s fundamentals is necessary for it to continue inflating. The growing number of promising reports often prompts hedge- and mutual funds to announce their plans to purchase the stock. The cycle of positive reinforcement gives the media more reason to focus their attention on the asset. Doing so can lead to speculation that it’s actually undervalued or how its real price-to-earnings ratio should be 20% higher.

These articles eventually grab the attention of retail investors who rush to buy the stock to not miss out on the predicted price hike. Unfortunately, what they find is a limited supply. At that point, the big investors are still holding on to their own stocks. Meanwhile, potential sellers try to push prices even higher by setting limit orders instead of selling at market prices. When the explosive growth in the number of market orders floods the order books. The result is an exponential price hike. The asset begins to outperform indices, rising even when the markets are going down. It enters a long upwards trend without any market corrections, sometimes increasing by 40-50%. By now, retail investors have taken the media’s bait and are thoroughly exposed to the product.

Final Stage Of Development

One of the telltale signs of a fully developed stock market bubble is that people continue buying the stock even after the company’s flash reports start falling short of expectations. These companies end up taking out loans or issuing bonds to finance their new projects in many cases. One variant of it is the convertible bond. It allows small investors to purchase a bond that they can convert to common stock when it expires. On paper, it seems like an excellent investment. You have a bond that both pays a fixed 5% interest and also rises in value by 30% every year. Unfortunately, it doesn’t work that way in practice, and it rarely turns out well for small investors.

One reason these companies fall short of expectations is that the forecasts eventually become completely divorced from reality. Even if earnings per share decline for two consecutive quarters, the resulting price drop is only temporary. Retail traders usually jump at the opportunity to buy the stock at a lower price before the rebound. In reality, this is the stage where the major investors sell the stock to realize their profits. As the situation is on the brink of reversing, hedge-fund managers are selling their positions to reduce exposure. The only way to find this information is to look for it. However, the media continues to maintain the asset’s positive outlook.

The Bursting Bubble

This is the exact window of opportunity short sellers look for. After price peaks two or three times, you can clearly determine the location of the uppermost resistance line. It’s also easy to observe how every time price hits that resistance line, positions get liquidated in large quantities. The lack of a successful breakout will eventually make retail investors concerned, which causes the demand for it slowly dries up. That’s when the first reports of the company underperforming start reaching the general public.

At this stage, a partial or full profit warning is enough to burst the bubble by prompting the major investors to liquidate their positions. Moreover, they had to do it while the market was liquid enough, meaning there are still buyers left. A result is an immense number of limit sell orders placed on the market. The contracts that didn’t get sold during the day turn into market orders at the end of the day. When retail investors catch wind of the downtrend, they start trying to escape as well.

The Collapse

From there on out, the rate of the descent begins to match the speed of the initial rise. The typical pattern is for the asset to go through a small recovery a few months after the initial crash. While a few small investors still hold their positions, although, at a 70-80% loss, most of the short sellers already closed their positions by then. The latter group was the driving force of the buying power in the market. Once they’re out, the stock market bubble has officially burst. All the hedge- and mutual fund managers closed their positions with a profit long ago. The short sellers made a tidy profit. Meanwhile, the retail investors from the general population tempted by the media are left holding the bill.