Last Updated on May 10, 2024

The McClellan Summation Index is a popular technical analysis tool for visualizing and understanding market breadth. It helps identify overall market direction and momentum. Developed by Sherman and Marian McClellan, the MSI aggregates daily values from the McClellan Oscillator over a predetermined period to ensure a birds-eye view of market trends.

By smoothing out daily fluctuations and filtering short-term noise, the MSI helps traders pinpoint bullish and bearish trends, confirm signals from other technical analysis tools, and identify overbought and oversold market conditions.

Now, let’s explore how the MSI works, how to calculate it, and how it can enhance your trading strategy.

What is the McClellan Summation Index?

The McClellan Summation Index (MSI) is the long-term version of the popular McClellan Oscillator. Like the Oscillator, the indicator was designed by the economist/mathematician couple Sherman and Marian McClellan. The MSI helps envision market breadth by measuring the ratio of total movements advancing compared to those declining over the same period. A higher ratio indicates a bullish market, whereas a greater proportion of declining stocks indicates a dominating bearish bias.

The MSI gives traders a big-picture perspective by smoothing out some of the Oscillator’s rougher edges caused by short-term fluctuations. We’ll directly compare the two shortly, but for now, remember that the Oscillator is the most straightforward measurement of short-term market breadth.

The MSI sums the Oscillator’s daily values over a predetermined period, typically 19 or 39 days. This process develops a cumulative total that gives traders a longer-term view of the market’s overall direction and momentum and discounts short-term volatility or one-off events.

You can use the MSI to pinpoint the market’s overall trend and determine whether the trend will continue or reverse. In general, a rising MSI indicates a bullish trend in the market, and a declining MSI signals bearishness.

As with most indicators, the MSI shouldn’t be used as a standalone tool. Instead, traders should combine it with other technical analysis tools to confirm signals before triggering a trade. And, again, like any technical analysis tool, the MSI is neither foolproof nor guaranteed and should be used in conjunction with appropriate risk management practices.

McClellan Summation Index vs. The McClellan Oscillator

Both indicators came from the same developers, Sherman and Marian McClellan. Both tools measure market direction and momentum, but they differ in approach and information provided. The MSI is an aggregate of Oscillator trends spread over a longer time horizon, making it more suitable for bigger-picture analysis. And vice-versa.

McClellan Oscillator Overview

The Oscillator measures the difference between two exponential moving averages of the number of advancing and declining stocks in the market. By doing so, it provides traders with a visual representation of the market’s overall direction and momentum. The Oscillator is a short-term indicator that tracks daily fluctuations in the market, rendering it most useful in identifying short-term trends and potential reversals.

When the oscillator runs positive, more stocks are advancing than declining. Likewise, if the oscillator is in negative territory, it means that more stocks are declining than advancing. The McClellan Oscillator can also identify potential trend reversals. When the oscillator crosses above the zero line from negative territory, it indicates that the market is starting to recover. On the other hand, when it crosses below the zero line from above, the market is about to decline.

Remember – The exponential moving average (EMA) is a type of moving average that weighs recent info more heavily than older data. Traders use it to spot trends and potential changes in market direction. The EMA differs from the simple moving average (SMA) because it’s more responsive to changes in price trends since it emphasizes recent prices that are usually more relevant to a current market situation.

Calculation

It’s also essential to understand the formula underpinning the Oscillator. The simplest way to understand the calculus is as a subtraction of the 39-period EMA of declining issues from the 39-period EMA of advancing stock.

The 19-period EMA represents the short-term trend, while the 39-period EMA represents the longer-term trend. By subtracting the longer-term EMA from the shorter-term EMA, the Oscillator shows you the momentum and direction of the market’s trend. You can plot the McClellan Oscillator as a histogram built around a zero line. A reading above the zero line means the short-term trend is bullish, while a reading below the zero line suggests a bearish trend.

You can also look for divergences between the McClellan Oscillator and the price of an asset to identify potential trend reversals. For instance, if the price of an asset is making new highs but the Oscillator isn’t, it may signal a weakening trend and a possible reversal.

An Overview of the McClellan Summation Index

Looking at markets more holistically, the MSI gives traders a longer-term view of direction and momentum by smoothing out the daily fluctuations of the Oscillator. The MSI is calculated by adding the daily values of the Oscillator over a period of time, typically 19 or 39 days. This gives traders a cumulative total with a longer-term view of the market’s overall direction and momentum.

The MSI is interpreted essentially the same way as the Oscillator visually, but strategically it is used for long-term planning rather than quick price action or momentum traders.

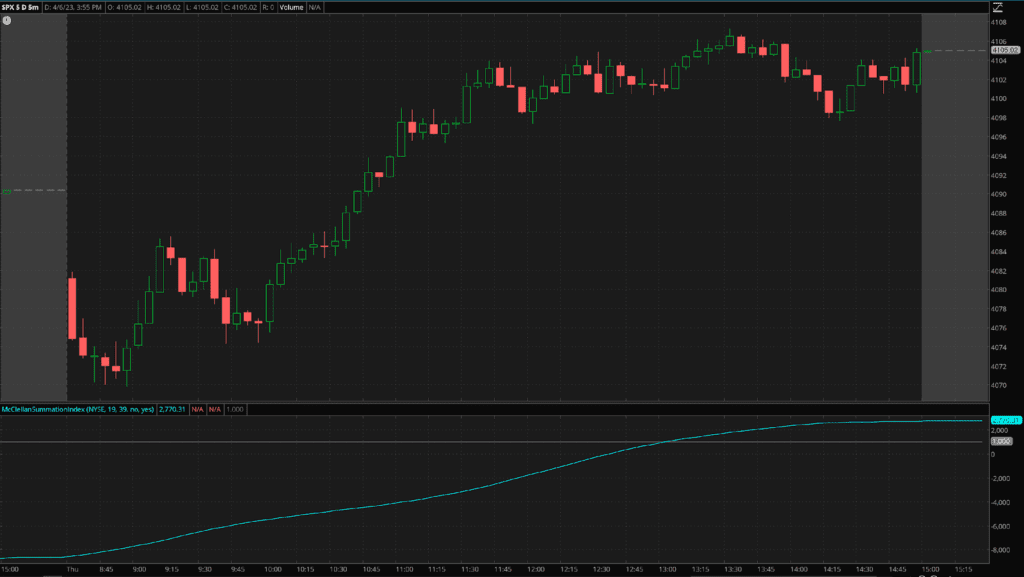

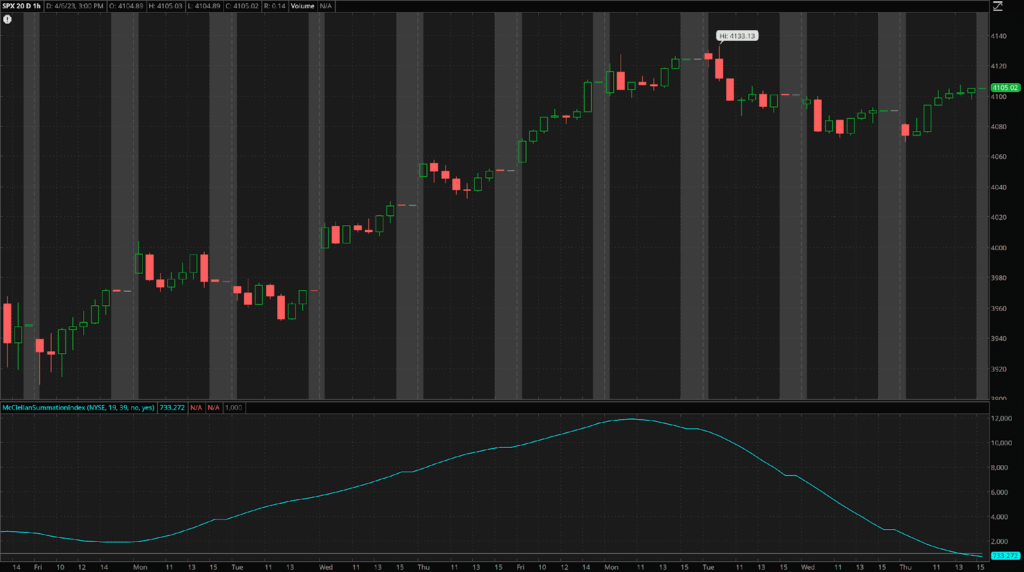

This chart indicates the relative smoothness of the MSI to the Oscillator’s whipsaw patterning over the short term.

How to Calculate the McClellan Summation Index

Calculating the MSI is a bit simpler than the Oscillator – but, of course, you need the Oscillator’s stats to feed the MSI. In short, the MSI is the preceding Oscillator values added over the preferred period. Most platforms and programs automatically generate the MSI based on your preferred parameters, but the core formulation looks like this:

- Calculate the daily Oscillator values by taking the difference between the 19-day and 39-day EMAs of the number of advancing and declining stocks in the market.

- Add the daily McClellan Oscillator values together to get the cumulative total.

- Calculate the 10-day exponential moving average of the cumulative total to get the MSI.

McClellan Summation Index = 10-period exponential moving average of the cumulative McClellan Oscillator values

Some traders tend to tweak the stats a little based on their preference and strategy, particularly how the EMA’s values are found, but the fundamental figure remains.

Traders also adjust the Oscillator and MSI’s time period to fit their specific trading strategy and preferred timeframes. It’s also critical to remember that the MSI is an aggregated, cumulative indicator that takes time to build a meaningful trend. Traders should use the MSI alongside other technical analysis tools to validate assumptions from the MSI.

Using the MSI for Technical Analysis

Traders draw three core technical assumptions from the MSI: positivity vs. negativity, divergences, and directionality.

Positivity and Negativity

Like other momentum oscillators, MSI indicates bullishness or bearishness when above or below the center line’s zero marker. For example, the MSI will trend positively when the Oscillator remains predominantly positive over an extended period.

It usually takes sustained, multiple positive or negative readings to shift the MSI into positive or negative territory. That is why the indicator isn’t as subject to volatility as the Oscillator.

Nevertheless, like all indicators, the MSI isn’t flawless and may produce whipsaws or periods where zero-line crossovers don’t maintain momentum for a significant duration.

Divergent Factors

Bullish and bearish divergences in the MSI sometimes give traders early indications of a potential reversal in the underlying index. However, not all divergences result in major reversals or extended moves. It is essential to distinguish between solid and robust divergences and weak, insignificant ones.

A bullish divergence develops when MSI marks a higher low, and the index forms a lower low. Even though the underlying index declines to new lows, the higher low in the MSI Index indicates a broad-based improvement.

On the other hand, a bearish divergence is when the MSI forms a lower high, and the index sets a higher high. Even though the underlying index advances to new highs, the MSI struggles to surpass its previous high and shows weakening breadth.

Traders should aim to differentiate between shallow, insignificant divergences and deep, robust ones. Moreover, bearish divergences in a strong uptrend are likely to fail, just as bullish divergences in a strong downtrend are. Small divergences that develop over a few weeks are more unstable than steep divergences that emerge over one to four months and should be treated with caution.

Deep Directionality

The MSI can be combined with an SMA to identify trend shifts. The duration of the moving average is determined by the individual’s trading or investment strategy and timeframe.

A shorter moving average gives you rapid signals, although with the risk of facing multiple false alarms along the way. A longer moving average may be slower to react but typically results in fewer false signals. This trade-off, of course, is one familiar to those relying on technical analysis, where faster indicators are more prone to false signals, while slower indicators may delay entry points.

Trading with the McClellan Summation Index

As with any indicator, the MSI’s usefulness hinges on the individual trader’s strategy and preference. Here are some of the most common ways traders use the MSI:

Trend following

Traders use the MSI to identify bullish and bearish market conditions for their trend and momentum strategies. For example, if the MSI rises, traders can look to go long. And vice-versa.

Reversal trading

Traders also use the MSI to identify potential trend reversals. For example, a bearish divergence between the MSI and the underlying security could indicate a possible downside reversal. Usually, divergence identification is among the areas in which the MSI shines.

Overbought and oversold market conditions

The MSI, like the Oscillator, can identify overbought and oversold market conditions. If the MSI is above a certain level, it might indicate that the market is overbought and due for a correction. On the other hand, if below a certain level, it could suggest that the market is oversold and due for a bounce. In general (not a set-in-stone rule), traders use the following thresholds:

- Bottoms below -1,300

- Tops above +1,600 (especially if reinforced by a divergence)

These two top and bottom levels historically and statistically indicate either an overbought or oversold market.

Confirmation trading

Traders use the MSI to confirm signals from other tools. For example, if a trader sees a bullish signal from a moving average crossover, they can confirm the signal with a rising MSI.

McClellan Summation Index Advantages and Disadvantages

As with any tool, the MSI is only as good as the trader and the strategy it supports. To apply it effectively, you should be familiar with its pros and cons. Here are the most important ones:

Advantages

- Good long-term view indicator – it is based on a long-term trend, so it’s great for patient traders who aren’t interested in jumping in and out of positions.

- Filters out short-term noise – it smooths out volatility and the effects of day-to-day market noise without signal.

- Easy to interpret – the MSI is among the most straightforward indicators to interpret visually.

Disadvantages

- Slow to react – the MSI’s expanded horizon isn’t great for day trading or even swing trades over a period of a few days.

- Can give false signals – like any technical analysis tool, the MSI can give false signals, leading traders to make incorrect trading decisions.

- Only works in certain market conditions – the MSI is designed to work in trending markets and may not be as effective in choppy or range-bound markets, which are becoming ever-more common nowadays.

Conclusion

Ultimately, the McClellan Summation Index (MSI) is a great technical analysis tool to give traders a longer-term view of market direction and momentum. Calculated by adding the daily values of the McClellan Oscillator over a certain period, the MSI smooths out fluctuations and volatility from its baseline source.

Traders use the MSI to identify bullish and bearish trends, confirm signals alongside other technical analysis tools, perform divergence analysis, and identify overbought and oversold market conditions. Its primary advantage of giving traders a long-term view and filtering out short-term noise is somewhat offset by being slow to react and occasionally giving false signals, so it should be used in conjunction with other tools and not solely relied upon – and, of course, strategically aligned with your risk management plan.