Last Updated on October 12, 2023

One of the most attractive features of the futures market is that it allows for trading with leverage. This means traders can commit a relatively small amount of capital to make large trades on an asset. This leverage is made possible thanks to what is known as a futures margin. In this guide, we take a closer look at what futures margin is all about and how it affects your trading capabilities.

What is Futures Margin?

In simplest terms, futures margin is the minimum amount of funds you need in your trading account to initiate a buy or sell futures position. This margin is usually a fraction of the contracts’ total value. The actual amount varies from market to market and typically differs if the trader makes a day trade or holds the position overnight.

Margin allows for trading with high leverage, which is actually a crucial instrument in the futures market. You don’t need to put up 100% of the futures contract’s value amount when initiating a trade with leverage. Instead, you can use your margin amount to enter large positions and continue to trade as long as your account remains funded.

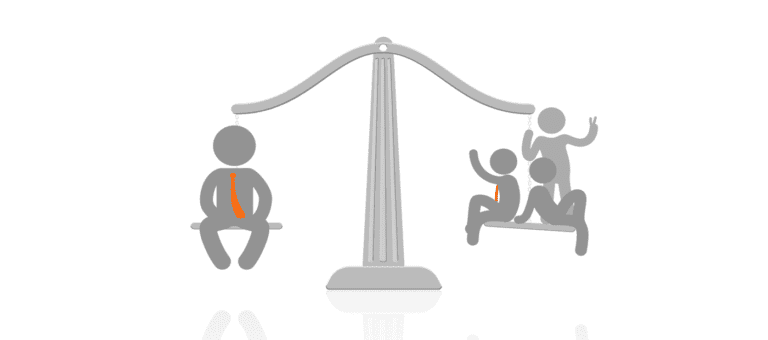

Keep in mind that leverage is a double-edged sword. While small changes in the asset’s underlying price can translate into hefty gains, they can also result in significant losses. These losses may be way higher than your original margin amount, should the trade swing the other way.

You might also like:

- 5 Things To Know About Trading E-Mini Russell 2000 Futures

- 5 Differences Between The S&P 500 E-Mini & The Micro E-Mini Futures

Futures Margin vs Securities Margin

The term margin sees wide usage across multiple financial markets, including the stock market. As such, it’s important to first understand the differences between margin for futures and margin for stocks/securities. You should understand these differences before trading futures contracts.

A margin refers to the money you must have in your account to borrow against your assets in the stock market. The amount you borrow is kind of like a loan, which allows you to access greater sums of capital to buy and own stocks, bonds, and ETFs. This loan allows you to leverage your positions. This is a practice we refer to as buying on margin and essentially amplifies your trading results to gain bigger profits on successful trades.

However, in the futures market, a margin is the amount of money you must deposit and keep on hand with your broker when entering a futures position. Keep in mind that it is not like a down payment. Funding your futures trading account with the required margin doesn’t mean you own the underlying commodity. You can think of it as a good faith deposit without which you won’t be able to enter the trade in the first place.

Another key difference is that futures margin typically represents around 3-12% of the notional value of each futures contract. Whereas securities margin generally requires traders to put up to 50% of the face value of securities being traded.

Types of Futures Margin

There are two main categories of margin in the futures markets:

- Initial margin – This is the minimum amount set by a futures exchange platform to enter a futures position. While it is the exchange that specifies the margin amount, your broker may also require you to deposit additional funds before you can begin trading.

- Maintenance margin – This refers to the amount that you must maintain at any given time in your trading account to cover potential losses on your positions. The maintenance margin amount will be lower than the initial margin.

| Symbol | Exchange | Init. Margin | Maint. Margin | |

| E-Mini S&P 500 | ES | CME | $13,200 | $12,000 |

| Micro E-Mini S&P 500 | MES | CME | $1,320 | $1,200 |

| Crude Oil | CL | NYMEX | $6,160 | $5,600 |

| Gold | GC | COMEX | $9,185 | $8,350 |

| 10 Year US Tr-Note | ZN | CBOT | $2,035 | $1,850 |

*information as of 12/31/2019, Source (Taken on 2020 March 30): GFF Brokers

In addition to the initial and maintenance margins, there are two subcategories of futures margins that you should know about:

- Day trade margins – This is basically an initial margin for a full day’s trade. This means it is the minimum amount required to day trade a contract. With day trade margin, you’re basically opening and closing your futures position within the same trading session and not carrying it forward to the next day’s trading. This margin is set by the broker.

- Position trade or overnight margins – This is the margin required to hold your position past the closing time of the market and into the next trading day. This margin is set by the exchange based on the futures contract’s market value and volatility.

What is Margin Call?

If the funds in your trading account drop below the maintenance margin, you may receive a margin call. In this case, you will need to deposit more funds immediately to bring it back up to the initial margin level.

If you cannot meet the margin for some reason, you could reduce your position depending on funds remaining in your account. Alternatively, you could close out your position. Sometimes your broker will close your position within a certain time period if you do not address the margin call.

For example, suppose you opened a new account with your broker and deposited $15,000. Let’s say you then purchased E-mini S&P 500 futures contracts. The initial margin required was $6,600 per contract, so you could buy two contracts worth $13,200 (2 X $6,600). Let’s say the maintenance margin required was $6000 per contract, so $12000 for the two you just bought.

However, market volatility did not swing in your favor. The position incurred losses, and your account balance fell to $10,000. This is $2,000 below the maintenance margin and will result in a margin call from your broker.

To retain the positions, you need to increase your account balance by $3,200 to bring it back up to the $13,200 initial margin. Alternatively, you could close one of your positions so that the maintenance margin drops to only $6,000. Or you could close out both positions at that loss and continue trading as desired.

How Are Futures Margins Calculated?

The exchange governs the futures margins through a calculation algorithm known as the Standard Portfolio Analysis of Risk (SPAN) margining system. It uses a highly sophisticated methodology to determine futures margin requirements by analyzing the “what-ifs” of just about any market scenario.

SPAN Margin Overview

SPAN uses a complex algorithm to assess overall risk. It does so by calculating the worst possible loss that a portfolio might reasonably incur over a certain period of time, typically one trading day. It does this by computing the portfolio’s potential gains and losses under different market conditions.

For example, CME uses the SPAN system to determine its futures margins. It utilizes the SPAN risk array methodology to assign a set of numeric values. These values indicate how a particular futures contract will realize profit or loss under various conditions, known as risk scenarios. Each risk scenario considers key factors, including changes in the underlying price of the index, current market volatility, and a decrease in time to the contract’s expiration.

The SPAN margin utilizes the Value at Risk (VAR) statistical concept to determine the initial margin. It’s based on the premise that it should be adequate enough to cover losses incurred in a position in 99% of the cases based on historical data. Essentially, SPAN assesses risks involved with each contract — the greater the risk, the higher the initial margin.

CME SPAN Parameters

The CME is one of the most popular exchanges for futures contracts. Therefore, other exchanges and clearing organizations use CME’s SPAN parameters to compute their desired degree of risk coverage. These parameters include:

- Price scan ranges (Scan risk) – This refers to the highest price movement that is most likely to occur for each instrument under a specified time period.

- Volatility scan ranges – This is the highest level of change that is most likely to occur with the underlying volatility affecting each futures option’s price.

- Intra-commodity spreading parameters – These are the rates and rules used to evaluate risks of closely related products among portfolios.

- Inter-commodity spreading parameters – These are the rates and rules used to evaluate risk offsets between related products.

- Delivery (spot) risk parameters – These are the rates and rules used to evaluate the heightened risk of futures positions that involve physically-deliverable products, as the delivery period approaches.

The Main Benefits of Futures Margin

The most obvious benefit of futures margin trading is that it helps to avoid a buildup of losses. Futures margins essentially hedge the risks typically associated with the highly leveraged futures market. That’s because futures margin allows for sufficient liquidity in this highly leveraged market since accounts must be topped up to continue holding a losing position.

It also protects your equity from total wipeout in a losing position since the exchange and your broker will require you to top up your account whenever it reaches a certain level.

Another key benefit is that the system ensures that traders fully meet their futures contract obligations. This eliminates counterparty risk. With the futures margin system, all futures contracts have sufficient equity for settlement. This, in turn, provides the safe and reliable futures trading environment that exists today.

Disadvantages of Futures Margin

The prevailing drawback of the futures margin system is that you need to settle daily losses on each contract. This really tests your holding power to maintain your margin balance.

Sometimes, the underlying index can enter bearish territory for days without any significant gain. But then make a sudden turnaround in one day and start posting some juicy profits. This means traders may have to hold their positions throughout that period, which incurs additional equity injections for overnight margins.

Final Thoughts

Many new traders look at futures margin requirements in a somewhat negative light. However, in practice, the margin is what holds the futures market together. It provides certain safeguards against the unfavorable impacts of market volatility and an assurance that market participants will meet their obligations at all times.

Understanding futures margin is essential to any futures trader and is one of the many preliminary steps you need to master before flexing with real money.