Last Updated on June 5, 2020

The European Central Bank (ECB) has made an effort to ensure that the continent’s businesses have easy access to capital. Their goal is obviously to stimulate economic growth by increasing the supply of money in circulation. Cheap credit is a strong influence on the directional flow of capital and the real estate sector is often the primary beneficiary of this change. Given the right market conditions, this can lead to a rise in long term investing, since these projects only tend to show a return in approximately 5-10 years.

You might also enjoy:

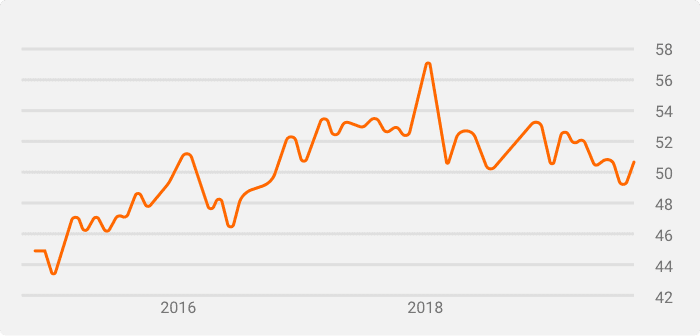

One of the best ways to measure this sector’s performance is the Construction Purchasing Managers’ Index (PMI). While lowering interest rates would normally support the industry, the data suggests a different outcome. The EU’s Construction PMI soared until 2018, at which point it started to steadily decline.

EU Construction PMI

Real Estate Industry Trends

The chart above clearly indicates a downward trend and 2019 saw a three year low in the number of orders placed by purchasing managers in the industry. One of the likely reasons for their worsening outlook is the prevalence of rent control laws in many of the major European cities. It’s also worth noting that income from rent is also on the decline. Most likely this is due to personal loan interest rates having settled at around 1.79%. That’s roughly half the amount one would hope to gain from rental income.

Although the industry is still nowhere near any kind of serious risk, investors are already looking limit their exposure and diversify into other areas instead. On the other hand this also means that the ones driving the real estate market are the general population, looking to benefit from the lower base interest rates, by purchasing homes for themselves. Compared to 2018, the percentage of the population that owns real estate increased by 0.1% in 2019. This means around 500,000 people bought new homes. The presence of households on the real estate market also has a tangible effect on prices. The Eurozone House Price Index increased by 2% in the Q3 of 2019, after being completely stagnant earlier that year.

Real Estate Investment Trusts

From a US investor’s point of view, buying European real estate seems like a somewhat costly proposition. Only a few are comfortable with taking the risk due to a lack of knowledge about the region and its various special regulations. Real Estate Investment Trusts (REIT) on the other hand are just as present on the European market as they are in the States. It goes without saying that the local regulations in Europe vary greatly from those in the US. However, investors in European REITs still get to take home a large chunk of the earnings. The bigger ones offered their shareholders an impressive dividend of over 7% in 2019. The largest European REIT is the German based Vonovia, with it’s 28 billion euro market capitalization. Second place goes to to Unibail-Rodamco-Westfield in the Netherlands.

The shares of these two particular companies are considered market leaders in Europe. Their high dividends make them attractive targets for those looking to indirectly invest in real estate. Unibail’s shares rose from 117 euros to 145 euros on the Amsterdam Stock Exchange. This increase followed the ECB’s August 2019 interest rate slash. A price rally of 20% in a period of only 3 months is both surprising and impressive for a dividend based security. Vonovia is traded on the Xetra system, operated by the Frankfurt Stock Exchange. It initially increased from 42 to 49 (although it has declined somewhat since), which is a 15% price increase.

The above trends could be seen az an indicator for rising investor confidence in companies that invest in the real estate market. Both of these companies are still more than 10-20% below their 2018 peak prices. If the trend prevails there’s still room for them to grow. Meanwhile their projected dividends for 2020 continue to remain high.