Last Updated on December 14, 2018

The results of recent economic reports coming out of developed markets have taken analysts by surprise. It was already expected that the European Union would be facing severe difficulties due to the Italian Government’s financial troubles as well as the United Kingdom’s upcoming exit. What most didn’t expect was that Germany, which accounts for 21.3% of the EU’s economy, would have a GDP growth of 0.2% less in its third quarter of 2018. Afterwards and before German investors could recover, Japan released an equally unfavorable report of -0.3%. Could this be the first sign of a coming recession?

Analysts, economic policy makers and central banks all reacted to the negative growth rate immediately and scrambled to justify the figures in an attempt to project confidence towards the market. In Germany’s case one of the underlying reasons is the dry weather which made the country’s waterways unsuitable for sailing and thus hindering order deliveries. The other reason is the Volkswagen scandal about their manipulation of auto emission figures forcing the EU to enact new regulations about how to measure said emissions, that manufacturers had trouble complying with. Consequently a number of them had to suspend their licenses to produce various auto types until they’re re-issued by Brussels. Even if this is a temporary state of affairs, it’s still a sufficient explanation for why economic growth has been on a decline all across Europe. The final quarter of 2017 still showed a promising 0.7% increase, however it has been steadily decreasing all throughout 2018. The last quarter grew only by 0.2%, showing that it’s not only Germany that’s slowing down, but the rest of the members as well.

Meanwhile the situation in Japan was focused more around natural disasters. The country was hit by a number of natural disasters during the third quarter which led to a decrease in household consumption. At the same time both corporate and government investment have also declined. It’s worth noting how export activity shrunk by 0.1% as well, for which the negative effects of the natural disasters are not a sufficient explanation.

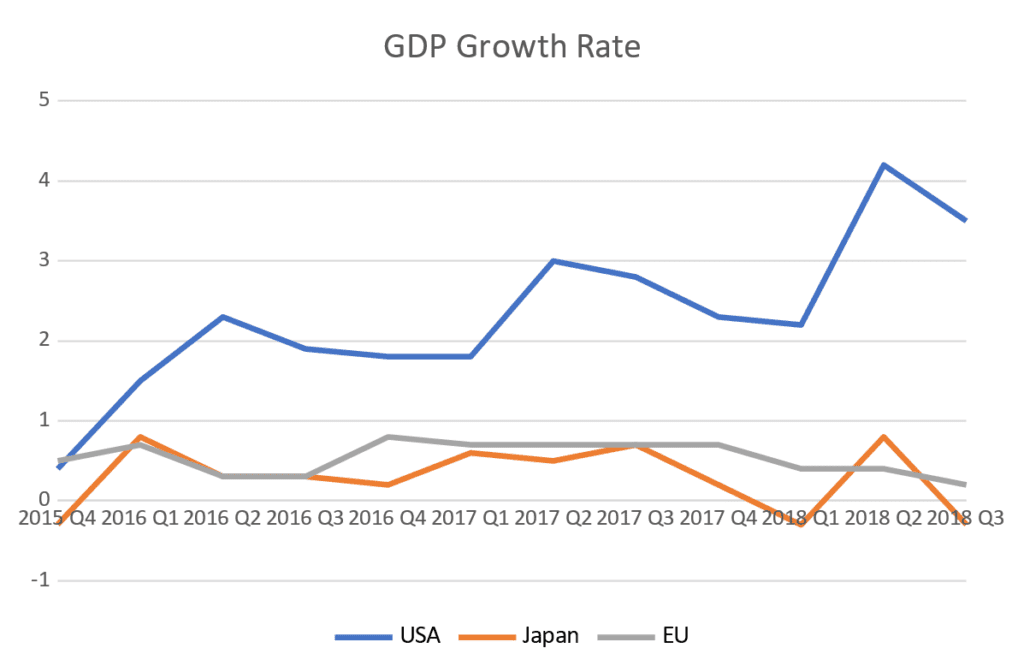

The above chart shows illustrates the performance of the US economy in 2018, growing by 4.2% in Q2 and 3.5% in Q3. This was accomplished despite the constantly rising interest rates making credit more expensive and the Fed’s attempts to tighten money supply, both measures that cut against the economy. Meanwhile interest rates in Europe are at a record low of 0% and the European Central Bank (ECB)’s economic stimulus bond-buying program will remain in effect until the end of year. Japan in comparison is even more active in supporting its market, since it’s negative base interest rate of -0.1% encourages the rotation of money and the Bank of Japan (BoJ)’s own asset purchase program actually expanded in Q3 of 2018. The latest data suggests the BoJ spent the equivalent of 95% of Japan’s GDP on purchasing various assets, whereas the Fed’s own quantitative easing program only spent approximately 30% of GDP even at its peak.

The present state of the currency market seems to favor the competitiveness of EU and Japanese economies, since the dollar’s strengthening seems to be the defining trend. Due to the strong dollar, most analysts expected the more export oriented EU and Japanese economies to have a price advantage over US products, which would have a stimulus effect on their respective economies while at the same time negatively affecting the USA’s growth rate. The data on the other hand shows that is not what happened, since the price of oil, which is tied to the dollar, increased significantly in Q3 of 2018. This phenomenon wrecked the EU’s otherwise positive trade balance when their energy import costs increased by 24%, showcasing the Achilles heel of Europe’s economy.

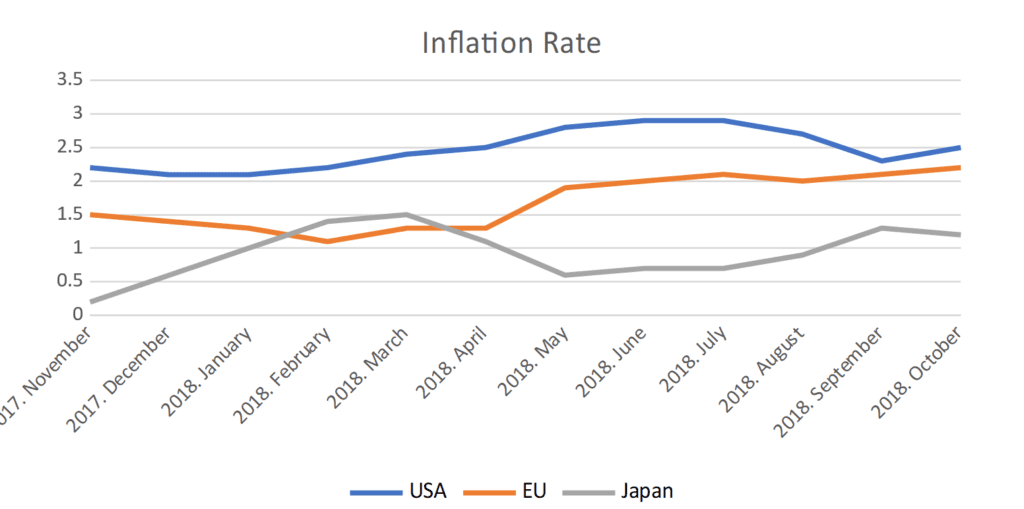

Combining the weakening euro with the growing energy prices has put the EU’s inflation rate on an upward path.On the one hand we see a slowing GDP growth and on the other a rising inflation. There’s little difference between the USA’s and EU’s inflation rates, however, the Fed seems intent on maintaining it’s policy of continued rate hikes unlike the ECB, which is content with its current rates. In fact, the ECB seems to outright reject the very notion of a base interest rate hike, since doing so would increase the ability of its many debt-ridden member states to finance themselves, thus worsening GDP growth even further and possibly even triggering a recession. The BoJ is very much in the same boat of being unable to risk a rate hike, since Japan’s trade balance was negative for the first 10 months of the year despite the weak yen. The reason Japan and the EU find themselves in the same situation is due to both strongly lacking energy independence, which prevents them from turning their weakening currencies into a competitive advantage as they still have to pay more for raw materials. A potential solution could be circumventing the dollar in the commodities market. Doing so would be no small feat, however, the EU and Russia have already started moving forward on trying to tackle the issue.

Unfortunately the USA’s recent trade policy is also part of the reason for why the EU and Japan’s economic outlook hasn’t improved. The recent forecasts by the International Monetary Fund and the Organisation for Economic Co-operation and Development both predict a global slowdown in 2019, narrowing what little wiggle room Brussels and Tokyo had left in their economic policy even further. More importantly it will also worsen their negotiating position in trade talks with Washington and the current administration has been aware enough of that fact to boldly push its economic agenda. The fundamentals based on the latest macroeconomic data also suggest that the dollar will continue to strengthen against both the euro and the yen. If the trade dispute between China and the US were to reach a global scale, neither Europe nor Japan have the potential to tussle with the US.