Last Updated on September 8, 2023

Copper is a common metal with a wide range of applications across multiple industries. Mining companies and distributors often use copper futures as a hedge against any losses due to price changes. However, these contracts are also popular among speculators looking to profit off of those same price changes. Owing to its significance, copper futures are traded across most major exchanges. The market’s trade volume has been on the rise over the years as both retail and institutional investors look to tap into this market for different purposes. This article will explain what copper futures are and how one can trade using these contracts.

What are Copper Futures?

Copper Futures are standardized contracts in which two parties agree to buy or sell copper at a future date for the current price. A person going long on the contract agrees to purchase a certain quantity of copper at a predefined date and price. The person going short has an obligation to deliver and sell it at the specified price on the contractual date.

Let’s take an example of how copper futures work. Suppose two people agree to trade on a contract with 25 tonnes on the LME and the price per tonne being $9172.50. If the contract’s maturity date is 3 months, then the buyer must pay approximately 25 times $9172.5, meaning a total of $229,312.50 to deliver 25 tonnes of copper after 3 months. In most cases, the contract buyer rarely goes for the delivery options. Usually, they settle the trade with an offsetting position, or a cash-based settlement occurs.

Likewise, a person entering a short futures position must deliver the metal’s equivalent quantity at the specified time. Suppose, in the above case, a trader goes short on the futures contract. He takes on the obligation to deliver 25 tonnes of copper in 3 months and receive $229,312.5k.

Copper Futures Contract Specifics and Technical Overview

Like other futures contracts, copper futures are a standardized contract. The table below highlights the copper futures contracts’ specifications in the London Metal Exchange (LME).

| Contract Code | CA |

| Underlying Metal | Grade A Copper |

| Lot Size | 25 tonnes |

| Price Quotation | US dollars per tonne |

| Clearable currencies | US dollar, Japanese Yen, Sterling, Euro |

Generally, these contracts are liquid in nature, and the buyer of the contract can exit the position before the actual expiry date. For example, a person going long on a contract that expires in 3 months can simultaneously take a short position on a similar contract. This way, the combined effect of both the short and long positions has no impact on profitability. Another way of dealing with the contract is by rolling over the contract for a future date. This is a common way to extend an existing position.

Why Do People Trade Copper Futures?

As mentioned earlier, copper is an important metal. The demand for copper is often a useful benchmark to help determine an economy’s health. Many investors keep a portion of their portfolio in metals like copper as a way to diversify. In most cases, copper provides a less volatile option for traders. By entering into a futures position, the trader can take a leveraged contract instead of buying the metal’s equivalent amount. They have to pay an upfront initial margin at the exchange while ensuring that they don’t breach the maintenance margin level.

Copper futures are a crucial financial instrument for companies involved in mining the metal. By entering into a futures contract, these companies can lock in a price for selling the product and remain insulated from any price fluctuations that may arise.

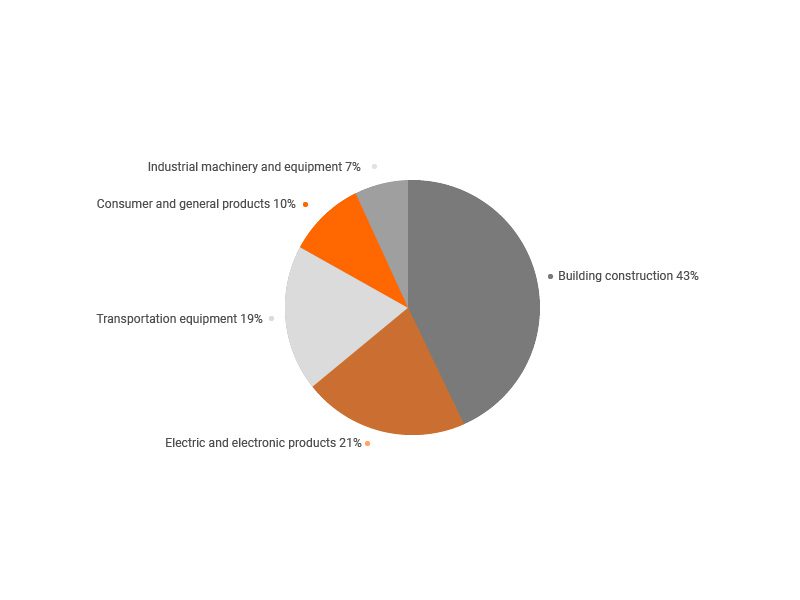

Copper is a metal that finds its application in several industries. Its common uses include housing construction, electrical wiring, consumer products, and industrial equipment. Any surge in its price can make these products expensive. This also means that these manufacturers may not necessarily pass on this additional cost to their customers. Therefore, these businesses enter the futures market and lock in a buying price for the metal ahead of time. The drawback of such a position is that if the price falls, the manufacturer will not benefit from this reduction. By locking in a fixed rate, these manufactures can focus on their core business. This lets them not worry too much about the price.

The next section will elaborate more specifically on the market participants who trade copper futures and how they can benefit from the market.

Who Trades Copper Futures?

Broadly speaking we can separate participants in the copper futures market into the following categories:

- Mining companies: These companies have a direct interest in copper prices since their bottom line is directly tied to them. While mining companies can somewhat control the supply, demand plays an important role in determining the price and making the price volatile. Large mining companies have specialized finance functions that play an active role in the futures market.

- Manufacturers: This category is mainly companies that require copper as input material. Earlier manufacturers were purely involved in their core business without intervening in the financial markets. Owing to the financial markets’ flexibility, these firms’ finance arms use futures contracts to check their input costs. Additional competition among them has also spurred manufacturers to keep their costs in check using hedging.

- Investors: Investors are necessary for building liquidity in the futures market. They can have different motives for entering such a financial market. There could be a speculative trade based on technical analysis that traders could look to exploit. Copper futures also provide an additional asset class for investors looking to diversify their portfolios using alternative instruments. There could also be investors who could hedge their exposure to the metal by taking an offsetting position. If an investor expects the equity investment in a copper mining company to drop due to a reduction in the copper price, he can enter a short futures contract.

How to Trade Copper Futures

Trading copper futures is simple, and several online platforms can be accessed for this purpose. Here’s a simple step-by-step guide for how you could start trading in copper futures.

Step 1: Open an account at a brokerage firm

An investor potential needs to submit their information, be it as a private individual or a company. They also need to put up a certain amount of capital before trading copper futures.

Step 2: Devise a strategy before taking a position

The strategies could be based on macroeconomic events or technical indicators. Macroeconomic indicators like GDP output and industrial output can sometimes be useful for predicting the future price of copper. Commonly used technical indicators include RSI, MACD, and EMA.

Step 3: Select the necessary inputs for executing a trade

For example, while trading copper futures at the London Metal Exchange, the relevant code would be CA. The trader should also choose the right contract based on the duration. Finally, the required initial margin must be posted in the account. Depending on the value of the contract you’re looking to trade, you can specify the appropriate number of lots.

We need to note that the account gets settled daily. If the balance in the account falls below the maintenance margin due to losses incurred, the trader would have to add additional funds.

Step 4: Monitor the price and follow your exit strategy if necessary

A successful trader has an exit strategy for both a profitable trade and a losing scenario as well. It is essential to create a stop-loss limit to reduce your risk. Once the price reaches this level, you might consider taking an offsetting position. Creating a stop-loss is one of the most fundamental yet effective risk management tools for a trader.

It is important to track events that can impact the price of copper and act accordingly. In extreme cases, contract settlement could happen by delivery, and in such cases, there is a physical delivery of copper to the counterparty who went long on the futures contract. Taking delivery could lead to additional difficulties like finding a storage space for a huge volume of copper.

Many platforms also have an option that allows traders to simulate a trading account without actual money. These platforms can be useful tools for practice. It also makes it easier to get a handle on their user interface. Traders can use them to put their theories to practice and backtest the outcome of their trades. It’s all too easy to make a mistake in the derivatives market. Because your trades are leveraged in nature, a careless mistake can cost you a lot.

Trading costs can also have an effect on the potential returns you might earn. Understanding the fee structure offered by various brokers is also one aspect that new investors should not neglect. Some brokerages offer a flat fee structure that is not dependent on the trade size, while others require a fee based on trade volume. Annual charges like maintenance fees can also erode the trader’s profitability.

Where Can You Trade Copper Futures?

Copper futures are standardized contracts and can only be traded on regulated exchanges. We’ll go into more details on some of these exchanges below. While each country would generally have its own exchange to trade copper futures, the exchanges discussed here are the ones with the highest trade volume. Owing to their size and the liquidity they offer, traders generally prefer these exchanges over other smaller ones.

COMEX

First on the list of exchanges is the Commodity Exchange or COMEX. COMEX is a part of the CME Group, and it offers a wide range of derivative products on different commodities. The CME Group is, in fact, the marketplace offering the most diverse offerings when it comes to derivatives. A standard copper futures contract comprises 25,000 pounds of copper in weight, and the price is quoted in US dollars. COMEX has also introduced E-mini copper futures, allowing traders to opt for a 12,500-pound contract instead of the standard 25,000 pounds. The smaller size ensures that retail traders can still enter the market. Opening it up to more traders provides additional liquidity in the market.

London Metal Exchange

The London Metal Exchange is the second most popular exchange for trading commodities. It’s a crucial venue for trading copper futures. This is primarily because most of the consumption and mining of copper occurs outside of the US. This is the preferred marketplace for traders looking for an opportunity outside the US. Compared to COMEX, the LME has a contract with an underlying weighing 25 tonnes for each futures contract. This is equivalent to an E-mini futures position in the COMEX marketplace.

Multi-Commodity Exchange

The first two names on this list have been dominating the derivatives market for quite some time. However, other exchanges have been propping up and gaining popularity among investors. The Multi-Commodity Exchange or MCX is a platform based out of India established in 2003. It has developed into a mature market for copper futures. The standard contract has a size of 1 tonne or approximately 2,200 pounds. A mini contract is 1/4th the size of the standard contract.

What Affects Copper Prices?

To understand what affects copper’s price, one needs to know the source of our copper’s supply and its various applications.

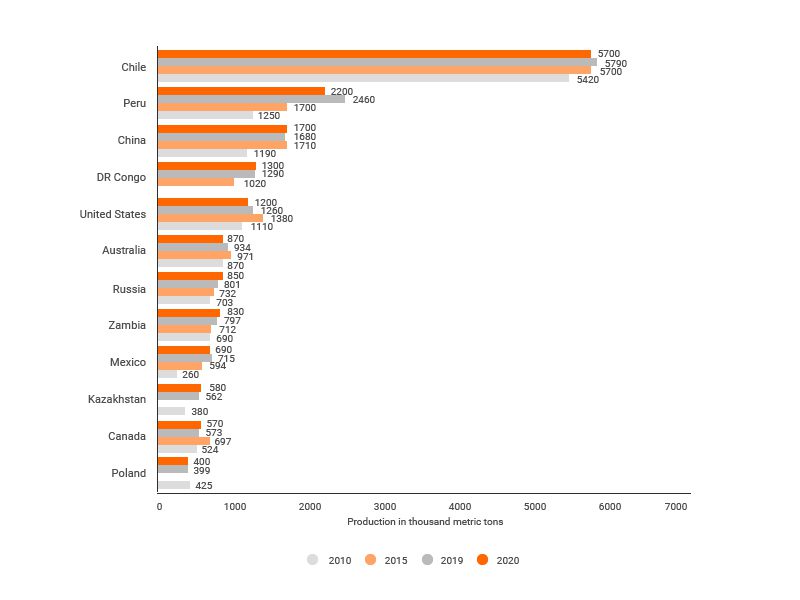

Looking at the chart above, we can see that although Chile leads the pack, the overall difference in production among countries is not much. Another interesting observation is that the volatility in production over these years for most countries is low. From a supply-side point of view, copper generally does not face major disruption. Generally, supply-side disruption is not a major factor affecting copper prices.

The demand for copper is the major factor that has a bearing on the price. Economic activity plays a major role in the demand created for the metal.

Looking at copper usage in the US, building construction contributes 43% to the overall usage. Other sectors also have a direct bearing on the general health of the economy. For copper’s price to trend upward, demand needs to be sustained in the sectors highlighted in the table. It is a common phenomenon to see the copper prices tank during a recession. Applying price action to copper is sometimes also used as a leading indicator of GDP estimates based on the wide range of copper’s applications alone. This, in turn, can be used to extrapolate the expected spot price. You could theoretically use those expectations as a basis for your decision on whether to take a futures trade on copper.

Final thoughts

Copper is still an important component of many products. Its price has a notable impact on the stock of the firms that depend on it. As a result of its importance, we’ve seen a sizeable and sophisticated futures market rise up around it, providing many trading opportunities.

It’s also worth pointing out that the process of placing a copper futures trade really simple. This makes it tempting for many investors to try and tap into an asset that exhibits one of the lowest volatilities among major commodities. For example, the price of crude oil has been known to be rather fickle. It’s constantly affected by supply shocks stemming from decisions taken by OPEC countries. The production of copper, on the other hand, is decentralized. This means the risk of producers manipulating price by monopolizing it is minimal.

Traders also have a wide range of options for the maturity of the contract. The global exchanges mentioned earlier also offer different contract sizes. Furthermore, we can easily access these instruments through online brokerage platforms. Being a derivative contract, traders should first be aware of these financial products’ risks before entering into a trade. It is also important to have a trading strategy along with a stop-loss. This helps us minimize losses if the trade goes against us. Hopefully, this article helped shed some light on why copper futures trading enjoys such popularity. If you’re planning on giving it a try, always remember to do your due diligence!