Last Updated on October 12, 2023

The futures market is among the most complex ones by design. As a derivative, futures contracts might naturally appear a bit more complicated for beginners than more traditional instruments like stocks or forex. A primary reason why investors and traders struggle to ensure a flying start in the futures market is that they skip or fail to get a thorough understanding of critical concepts like backwardation and contango. Due to this, they are unprepared to navigate inverted markets and suffer losses from their futures investments. This guide will help you understand contango and backwardation. You’ll also learn how these market conditions affect your futures portfolio.

What is an Inverted Market?

An inverted market is when the spot price and the price of a near-maturity contract of a futures instrument are higher than its far-maturity contract. Alternatively, when it costs more today than it would in the future.

Inverted markets can be a result of various reasons. One can be a short-term decrease in the supply of the commodity. To illustrate this with an example, consider situations where there is a political embargo over the biggest Middle East markets, a black swan event like the Suez Canal blockage, an OPEC policy to restrict exports, or a hurricane affecting an oil port. Such unfortunate events have the potential to disrupt the short-term supply of oil. Under such circumstances, today’s deliveries are much more valuable than those in the future. Naturally, the price of the near-maturity contracts will reflect this.

The principle works both ways. Situations that trigger high short-term demand will lead to higher prices for the futures contracts with near-term maturity. If the market expects to ease in the future, the prices of far-maturity contracts will remain lower.

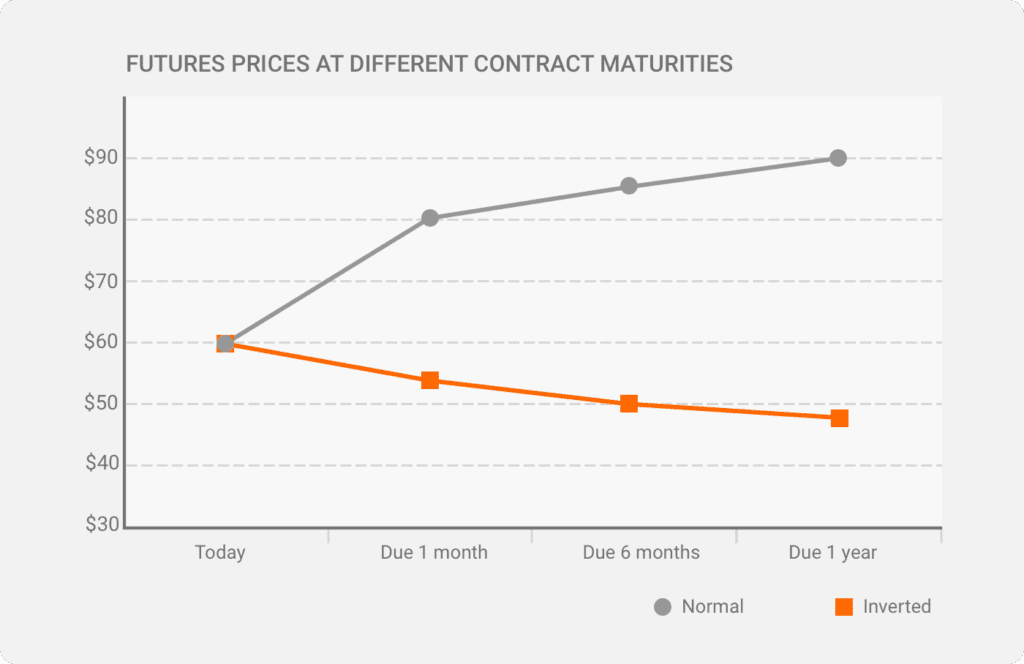

The market is called “inverted” as it is atypical for the spot price of near-maturity contracts to be higher than the one of far-maturity futures. In a “normal market,” the prices react the opposite way, and near-maturity contracts always have a lower price.

Why do markets invert?

Usually, in calm markets, the longer the maturity, the higher the contract’s price is. The reasoning behind this is that longer-term futures contracts are subject to much more uncertainty and risks. Markets ensure adequate protection by accomodating this uncertainty under the form of a risk premium in the price. Also, the increasing price over time usually reflects the expected spot price with added costs for the interest, storage, and insurance for holding the asset until maturity.

Inverted markets aren’t the dominant market condition. However, they’re still relatively common and can be seen in all futures markets. An inverted market might be triggered by a change in interest rates or trade policy for financial futures. Within agricultural commodities, they might be caused by supply shortages due to weather abnormalities.

What is Contango?

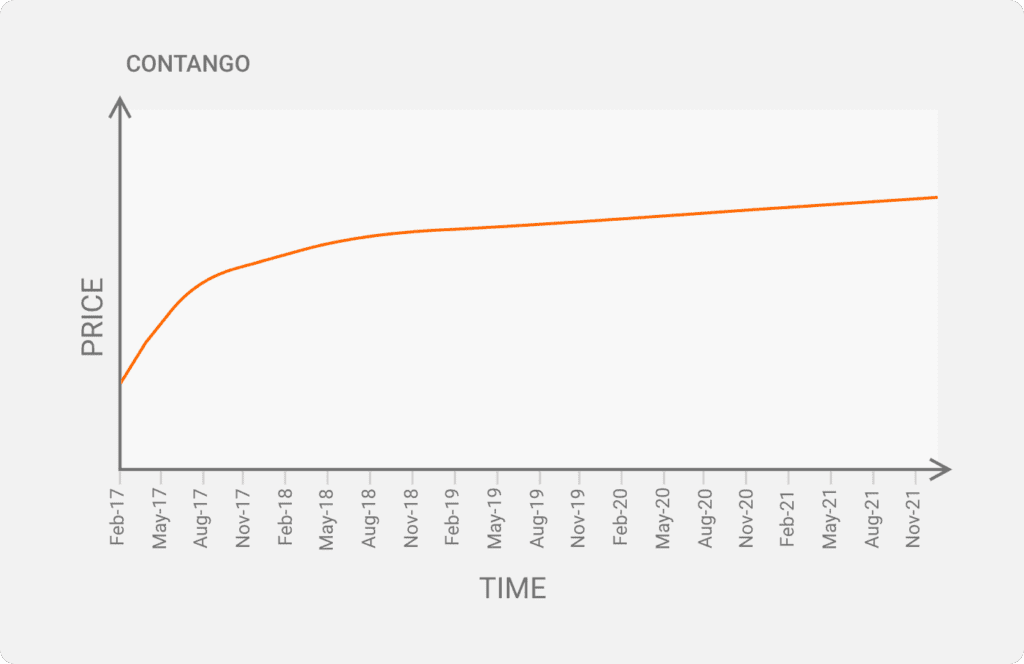

Contango is a state of the market where the futures price of a commodity is higher than its spot price. It is typical for most commodities as their futures prices usually rise over time.

Simply put, during a “contango” market, the spot price of crude oil is lower than the price of its futures contracts (CL). Alternatively, the price is sloping in an upwards trajectory as time progresses.

If you struggle to wrap your head around this definition, let’s take a step back and focus on what spot and futures prices mean in this context.

Futures contract: a legal agreement to buy or sell a physical commodity in the future.

Spot price: the current cash trading price for that commodity.

Example

Having clarified that, we can proceed with an example. A contango market is when the spot price of oil today is $70 and the futures price (let’s say two or three months from now) is $75. As you can see, there is nothing complicated with the basic definition of contango in commodities markets. It’s not a difficult concept to understand.

A contango in futures markets can result from various reasons. Projected future disruptions in the supply of the underlying commodity, inflation expectations, to name a few.

Spread traders and more aggressive market participants often prefer “contango.” These are the types of traders who aim to exploit the arbitrage opportunities between the futures and spot prices.

During contango market conditions, the general sentiment among investors is that they are willing to pay more for the particular commodity in the future than today. They tend to do so because of the so-called “costs of carry.” These are the costs that buying the asset today will incur due to having to hold it. Within commodities markets, these costs can include storage costs and depreciation due to spoiling, rotting, decay, or other conditions that deteriorate the quality of the asset.

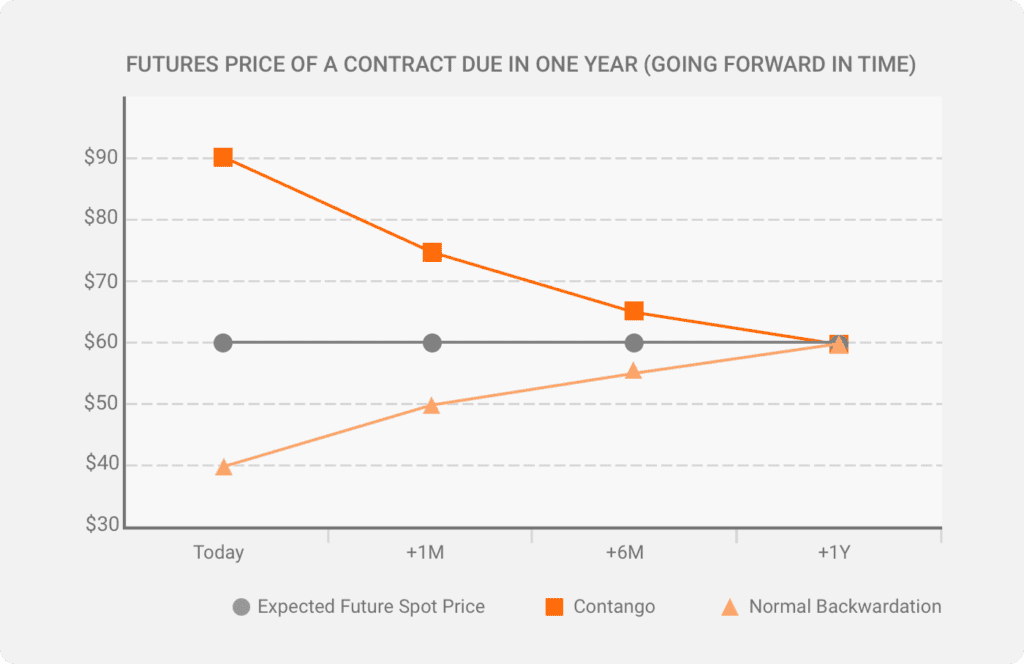

The critical thing to remember with contango is that, over time, as the contracts approach the expiration date, the futures prices always converge towards the spot ones. The case is the same with backwardation markets.

What is Backwardation?

The term “backwardation” describes a condition in the futures market where the spot price of the underlying asset is higher than the current trading prices.

The sentiment during a backwardation market is that the expectations for the current price are too high. Traders believe that prices are likely to fall in the future. The gradual decrease of the spot price over time continues until it eventually converges with the forward price of the futures contract.

Backwardation market conditions can occur when spikes in the current demand for the asset exceed the demand for far-maturity futures contracts. Another cause of backwardation in the commodities’ futures market is a shortage of the underlying commodity in the spot market.

Traders often exploit a backwardation market by shorting instruments at the current higher price and buying them for the cheap in the future, thus pocketing the difference. In a nutshell, a futures market in a state of backwardation benefits speculators and short-term traders who profit by applying arbitrage strategies.

However, it is worth noting that in the commodities’ futures market, there is the risk for the supply for the particular commodity to be manipulated or misrepresented to inflate the price of the instrument artificially. Due to this, traders should be wary about unfair market practices to avoid incurring significant losses. Furthermore, they should also look for situations where new suppliers join the market and the production ramps up. It will naturally resolve the commodity shortage problem and affect the price.

In a nutshell, backwardation scenarios require a hands-on approach where the trader continuously monitors the particular market.

Why are Contango and Backwardation Important?

Backwardation and contango are vital. They provide traders with crucial information about the current supply and demand for a particular commodity. Furthermore, they help market participants make better forecasts about their long-term positions. They also provide clarity about the best trading strategies traders can apply to profit from short-term and long-term developments.

Understanding the difference between backwardation and contango in futures markets can help traders avoid losses. A market participant capable of recognizing when a commodity is in contango or a backwardation condition can make a more informed decision about the market’s potential upcoming price direction and sentiments.

Failure to acknowledge contango and backwardation markets can be a recipe for disaster and result in substantial losses. In the “Derivatives Handbook: Risk Management and Control” book, the authors discuss the case of the German Metallgesellschaft company, which in 1993 lost more than $1 billion trading futures. The loss was attributed to deploying a hedging system that profited from typical backwardation markets but could not anticipate a shift to contango markets. As a result, the company was brought close to bankruptcy. In the end, it managed to survive thanks to a $1.9 billion rescue package from 120 banks. However, this case remained in history as an example of why risk managers should always account for contango and backwardation markets when trading futures.

Contango and Backwardation in the Futures Market

Contango and backwardation are terms that are only used in the futures markets. They define the structure of the forward curve and the expected development in terms of the future price compared to the spot price.

If the forward price of the contract is higher than the spot price, the market is in contango. If the forward price of the contract is lower than the spot price, the market is in backwardation.

Another way to look at backwardation and contango is through how the futures contract moves parallel to the spot price as it nears expiration. If it drops to meet the spot price, the market is in contango. On the other hand, if it goes up towards the spot price, then the market is in backwardation.

Futures traders look at contango and backwardation to better identify the observed difference between the current and the future price for the particular commodity or asset.

A visual representation

To help you understand the concept, let’s look at the following graph. It has two dimensions. The vertical axis represents the delivery price for the futures contract. Meanwhile, the horizontal one visualizes the time left to maturity. You can see how the price changes in both markets.

While during a contango market, the futures price decreases, it increases during a state of backwardation. The common thing between contango and backwardation futures markets is that, in the end, the spot and the futures prices converge.

You can often hear traders referring to contango and backwardation as a specific type of curve. That is because of the slope that the current and the futures prices form in both market conditions. Contango is an upward slope or upward sloping forward curve. Some also refer to it as “forwardation.” Meanwhile, backwardation is a downward curve.

Note! Many traders use the terms “backwardation” and “inverted market” interchangeably. The reason is that backwardation and inverted market conditions often appear together. However, they aren’t the same. They describe different situations, and an inverted market can occur either in a backwardation or contango market condition.

When can Contango and Backwardation Happen?

A contango market can exist for various reasons. Potential reasons include carrying costs (the costs associated with storage and insurance for the commodity), inflation, interest rate changes, bullish forecasts, and more. Among those, the most common triggers for a contango market are the cost of carrying and the rate of interest.

Cost of carrying is also referred to as “cost of holding.” The term describes the expenses you will have for storing the particular commodity if you buy it now. For example, let’s say you buy a couple of barrels of oil or a truck of corn. You will have to store them somewhere (i.e., a warehouse), which will incur additional costs. This might reduce the demand for the asset and lower its spot price. Meanwhile, it also increases the price of buying the commodity in the future.

Now let’s see how the interest rates can contribute to a contango market. If a trader postpones the purchase of an asset in the spot market because of going long, he essentially ensures more cash at his disposal. This cash can be used to earn interest until the trader decides to buy a futures contract. In that case, the spot price compounds at the interest rate until the asset is purchased in the future. This effect is reflected in the current futures price.

Backwardation

On the other hand, we can attribute backwardation to short-term events that drive the spot price higher than the future one. These might include supply shortage, market manipulation, convenience yield, and some other minor triggers.

Of these, the supply shortage is the most common reason. Let’s say that, as a trader, you are interested in corn futures (ZC). You know that the USA is the biggest producer and exporter globally. You have read the industry reports, and you are aware that the year has been good and there is enough supply. However, if a hurricane strikes suddenly and the main ports close. Such a disaster will inevitably disrupt the short-term supply of the commodity. These circumstances will create a backwardation market. In the long term, the supply will normalize. However, at this particular moment, the spot price will be higher than the futures one.

It is also essential to mention the convenience yield. When a sector or a few big companies expect a shortage in delivering a particular commodity, they might immediately increase their stockpile. While they will be hedging against limited future supply, they would also be pushing the spot price to go up. Traders often refer to this state as a “fear premium.” It’s typically reflected in the spot price but tends to normalize in the long run.

Examples of Contango and Backwardation

Examples of contango and backwardation exist in basically all markets. While we already covered a few scenarios that qualify in both market situations, let’s broaden that a bit and dig into a couple of other industries.

Contango often occurs in the gold industry as storage costs often accompany it. An example is when the spot price of gold is $1700 per oz, while the future price is $1900.

Contango in the oil market happens when the commodity’s spot price is $50 per barrel today, while the futures price for an extended delivery after one year is $75.

On the other hand, backwardation in the oil market occurs when the spot price is $45 per barrel, while delivery in 6 months is $35.

Contango vs. Backwardation

Futures contract supply and demand affect the futures price at each available expiration. The question is in what way. Based on the answer, the two possible market scenarios can be either contango or backwardation.

Here are the main differences to help you understate both market scenarios better:

| Contango | Backwardation | |

| Definition | A market condition where the spot price of the instrument trades higher than its future price. | A market condition where the spot price of the instrument trades lower than its future price. |

| Spot price | Higher | Lower |

| Future price | Lower | Higher |

| Price behavior | The closer it is to maturation, the lower the forward price drops to meet the spot price. | The closer it is to maturation, the higher the forward price gets to meet the spot price. |

| Reasons to occur | Carry costs, interest rate changes, bullish forecasts, etc. | Supply shortage, market manipulation, convenience yield, etc. |

| Curve | Upward-sloping | Downward-sloping |

| Frequency | Common | Rare |

Final Thoughts

Contango and backwardation are standard terms to describe the state of the futures markets. They help traders understand the current market situation. In addition, they help predict future developments by indicating whether the forward price is trading above or below the spot price.

Being aware of the differences between contango and backwardation is the only way to avoid losses when trading futures. No risk management strategy will prove effective if it doesn’t account for the current state and future forecasts for the relation between the spot and forward prices of the instrument. Furthermore, based on the market condition, a trader can make an informed decision on whether to go long or short.

If you are serious about making it on the futures markets, then the best thing to do is understand the intricacies of contango and backwardation markets. In the end, you don’t want to be the next Metallgesellschaft, right?