Last Updated on December 28, 2018

The US-China trade dispute seems like a distant and unimportant story to most Americans right now, but for soybean farmers it’s definitely an issue that hits close to home. They couldn’t even be happy about the record high crop yields, since prices are low and warehouses are full.

Ever since the beginning of this so called trade war earlier this year, the market has been keenly aware of how much US farmers have been hurting due to a lack of soybean sales. Only now that the harvest is over can we finally see the data on the full effects of China’s countermeasures. When the US initially came forward with its tariff hike, China threatened to retaliate in kind and they have followed through. Soybeans were always among the first on Beijing’s list of targets for revenge tariffs. The Chinese government, with its ability to control private companies, announced that they would no longer be buying soybeans or any processed soybean products from the USA to balance out their expected losses in trade. China was the largest buyer on the US soy market, purchasing 40 to 60 percent of its total produce. Even so, they still cut the import of US soybeans to zero almost immediately, only to show they weren’t simply making empty threats. This move has done a great deal of harm to both the US and its President in one fell swoop. Most soy farmers are based in Republican territory, which proves that the motive behind the tariff was not purely economic, but also political.

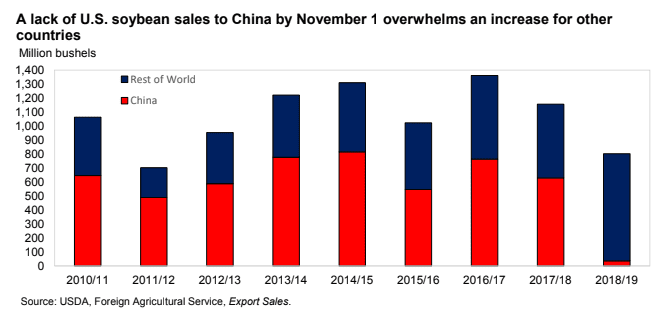

The following chart by the US Department of Agriculture illustrates the changes in US soybean export over the course of several years. Total export fell by approximately 20 percent and as mentioned before, Chinese demand dropped to near zero. The most striking thing about the chart, however, is the acute ability of US traders to quickly make up for the missing Chinese demand by finding new markets in other areas. US farmers have gained market share in Mexico, Egypt, Libya and other markets in Asia. If they can hold onto these markets until a potential trade agreement is reached with China, they would not only win back their largest buyer, but also seize a larger share of the global soybean market overall .As tempting as this proposition sounds, at this point the possibility of it happening may be nothing more than wishful thinking.

US producers currently find themselves in a tough spot. This year’s harvest was predicted to be an all-time high and have a price of over $9 per bushels, however, even though crop yield forecasts were accurate, the low prices resulting from the trade war were completely outside of their expectations. Soybeans yields reached 52.1 bushels per acre, which exceeds the previous high by 0.1 bushels and allows for the production of approximately 4,600 million bushels in 2018.

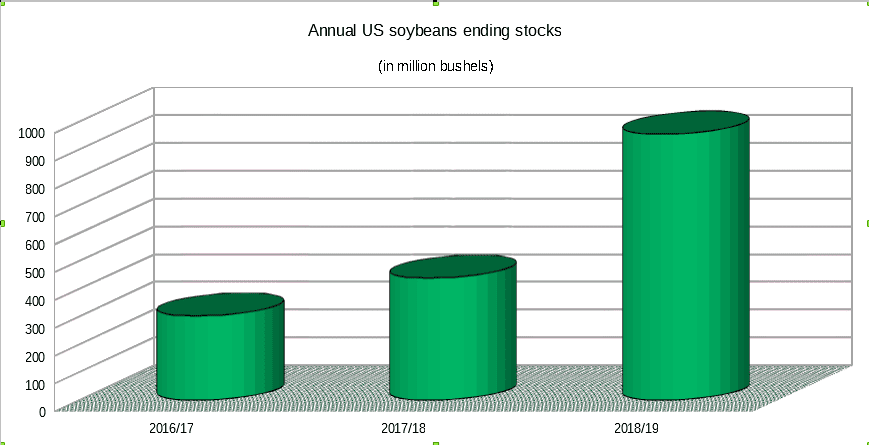

The combination or record high supply and the decrease of exports to China has resulted in stockpiles of ending stocks jumping sky high. The latest development in a series of bad news includes a lack of warehouse capacity pushing storage prices higher, thus dealing another blow to farmers.

Warehouses are now asking for 40 to 100 percent more for storage than earlier years. Along with the price reduction, this could result in an unexpected additional expense of 3 to 6 cents per bushels for farmers. Furthermore, the storage crisis has escalated to the level where some warehouses now charge farmers simply for dropping off their stocks. To make matters worse, this chaos caused by the record harvest could end up further increasing the pressure on soybean prices in the future.

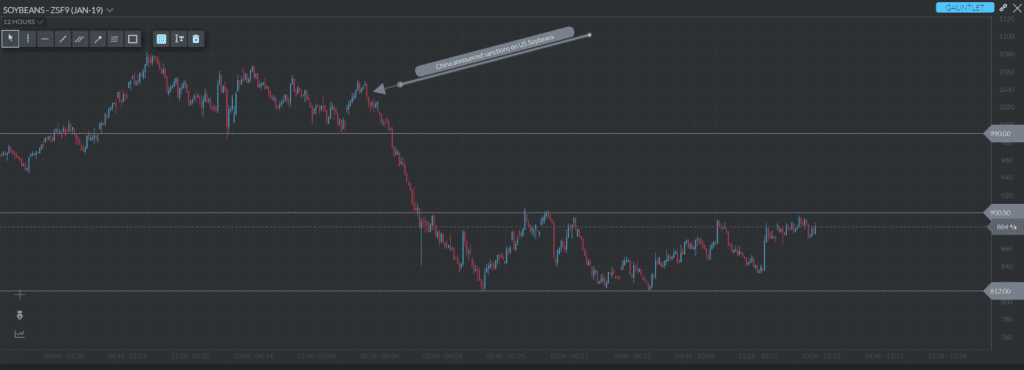

As seen on the chart above, soybean price dropped by 30 percent down from its annual high and has become unable to pass through the $9 resistance level. Its movement has been confined to the $8.12 to $9 range since July and it will likely stay within that area until trading conditions improve. At this point there isn’t sufficient momentum for an upward breakout and even the fundamentals paint a dire picture of the asset’s future outlook.

When even the Asia-Pacific Economic Cooperation Summit Farmers without so much as a joint statement between China and the US, traders and investors all placed their hopes on the G20 summit. The meeting between the two heads of state, Trump and Xi Jiping, represented the highest level of diplomacy and the perfect opportunity to reconcile. In the end, although both leaders talked openly and enthusiastically about economic cooperation, no actual decisions of substance were made. Whether this show of willingness to work together turns out to be an empty promise or an actual commitment to removing trade barriers on either side remains to be seen.